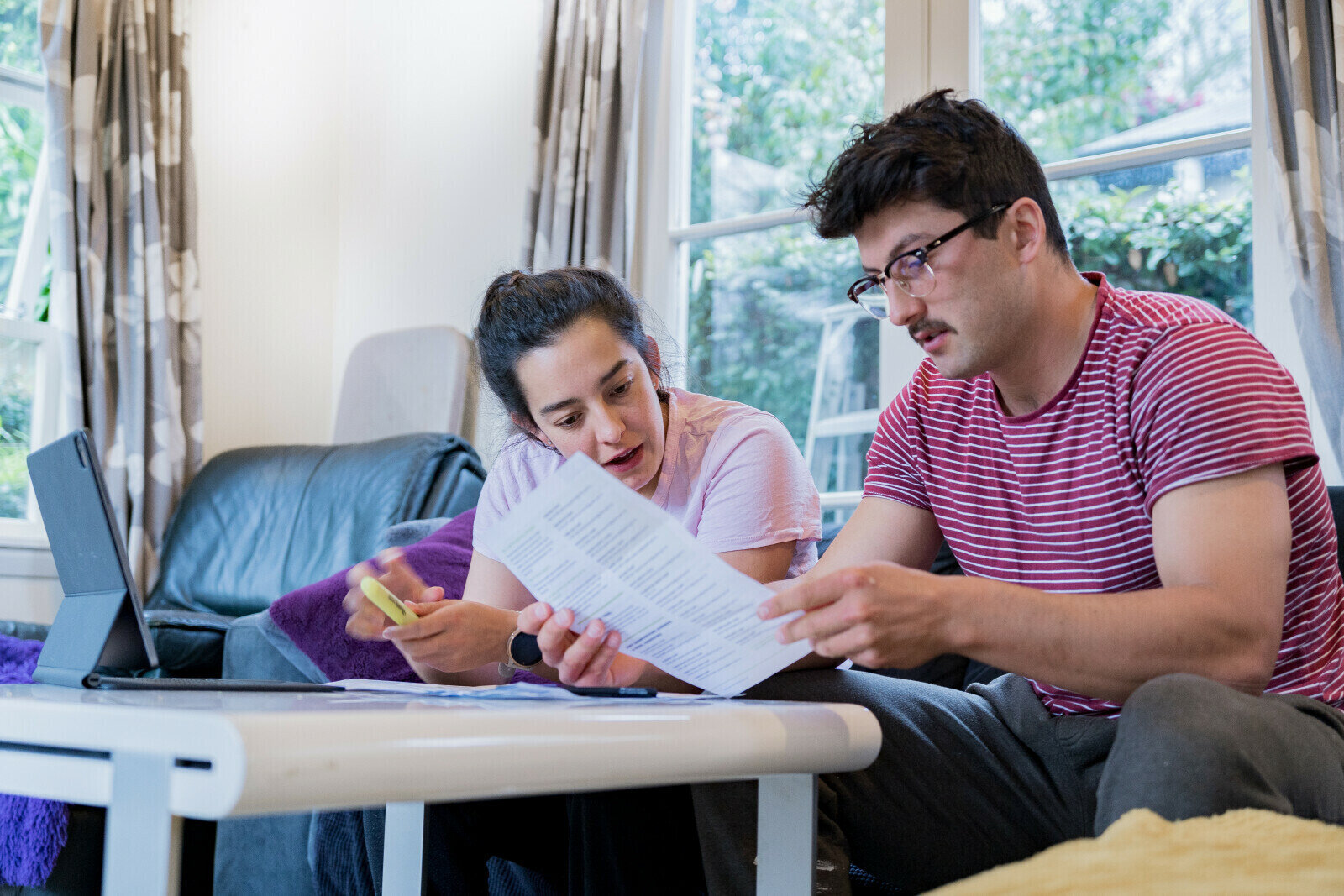

Planning before 40

Planning and managing your financial situation from starting work until around age 40

Starting work (even if you are a student) can begin your financial journey. You are automatically enrolled in KiwiSaver if you are over 18 and start your first job. 3% of your income is taken out and added to your KiwiSaver account and your employer will provide a contribution, as will the Government as long as you continue to contribute.

As you begin a full time role, your money situation changes. You have regular income. After a time of celebrating and spoiling yourself - it is a good idea to start looking towards the future. Can you capture some more of your income to save for a deposit on a house, or other goals? Should you put in place some Health/Medical insurance in case something major happens to you, so that you don't have to wait for treatment?

You may decide to purchase a home, this commonly involves taking out a mortgage. How you structure your mortgage can have a big impact on how quickly you get it paid off. If you have a mortgage you should make sure that you can continue paying the mortgage if you are unable to work because of illness or injury. You should start off with some income protection or mortgage repayment insurance and or trauma insurance, to protect you if something unexpected happens.

You may need life insurance if you have dependents, or if the bank asks you to put it in place (by the way there are likely to be better options for life insurance than the product the bank wants you to buy).

Having children might be part of your plan. This involves budgeting, monitoring your cashflow to fit all the costs into the income received.

The years from starting work to around age 40 are about making sure that you can fund all your costs, including repaying your mortgage. Making sure that you have the best quality and appropriate insurances in place for your situation, and if possible also slowly building up your KiwiSaver account, so that you are doing something about contributing to your retirement funding.