This is the information that you will receive in your 2026 Annual Review about our topics to discuss this year

KiwiSaver, Rates Rebates, Deposit Guarantees and Pengana Emerging Fund Manager Profile

2026 Project – Rates, KiwiSaver and investments at the bank + Pengana Emerging Companies Fund Manager Profile

Each year we focus on one or two projects to help you understand how decisions are made and what sits behind your portfolio.

New Deposit Compensation Scheme from 1st July 2025

New Zealand now has a permanent Deposit Compensation Scheme, which came into effect on 1 July 2025. This means that money you hold in bank accounts and term deposits is better protected than it has been in the past.

Under the scheme, up to $100,000 per person, per institution is protected if a deposit taker fails — provided the account qualifies under the scheme. This includes transaction accounts, savings accounts, notice savers and term deposits. In some cases, credit balances on credit cards are also covered.

This protection applies per institution, not per account. So spreading money across different banks or deposit takers can increase the amount that is protected. The scheme also applies to trusts, with the protection calculated per depositor.

Not every account automatically qualifies. Financial institutions are required to clearly state on their websites which accounts are covered, and the scheme does not apply to overseas branches.

The scheme is funded by levies paid by participating institutions. Over time, these levies will build a fund designed to provide protection if an institution fails. Some institutions may offer slightly lower returns as a result, and not all deposit takers will choose to participate.

Even where money is protected, a failure would still involve disruption and delays before funds are returned, so understanding who you are investing with — and why — remains important.

What does this mean for you?

If you hold more than $100,000 in cash or term deposits, this scheme makes it worthwhile to think about how that money is spread across institutions.

For many clients, this simply means holding deposits with more than one bank so that a larger portion of their savings sits within the protected limits. Doing this can involve some extra administration, such as meeting Anti-Money Laundering requirements and managing different maturity dates, but where balances are significant, the added protection is often worth the effort.

This isn’t something you need to rush or do perfectly. It’s about being thoughtful and practical with larger cash balances. We’re happy to talk this through with you and help you decide whether it makes sense in your situation.

A note on choosing deposit takers

You can find a list of deposit takers that offer DCS-protected deposits here:

https://www.rbnz.govt.nz/regulation-and-supervision/cross-sector-oversight/registers-of-entities-we-regulate/deposit-takers-that-offer-dcs-protected-deposits.

It’s important to understand that being on this list does not automatically mean an organisation is a good or low-risk place to invest.

The list includes a range of organisations, including some finance companies. When considering where to place your money, it still matters what the organisation lends on, how conservative it is, and what its credit rating looks like.

The Deposit Compensation Scheme provides protection if an institution fails, but it doesn’t remove inconvenience. Even where money is guaranteed, there can still be delays and administrative hassle before funds are returned.

This is why we continue to focus not just on whether deposits are protected, but who you are investing with and why.

Rates Rebates – could you be eligible?

(You might be surprised, especially if you have a SuperGold Card)

If you own your own home, you may be eligible for a rates rebate if your income is considered low. This often becomes more relevant once you are retired or semi-retired, when your income is mainly made up of New Zealand Superannuation and investment income. There is also more generous treatment if you hold a SuperGold Card, with a higher income threshold than applies to households without one.

In Budget 2025, the Government increased both:

· the income threshold for eligibility (from 1 July 2025), and

· the maximum rebate available.

Because of these changes, we decided to check how many of our clients might now qualify.

We were genuinely surprised. One client with a property in Wellington and an income of around $75,000 was entitled to the maximum rebate of $805. This was largely due to the high level of rates charged in Wellington, which meant the income level for eligibility was higher than expected.

Because rates (and eligibility thresholds) vary by council, the only reliable way to check is to use the calculator on the government website:

What you need to know

· The rates rebate year runs to 30 June and includes all rates: district, regional and water rates.

· You must be the legal ratepayer. If your property is owned by a trust, you need to be a named trustee and listed in the council’s Rating Information Database.

· The property must be your main place of residence as at 1 July of the relevant year.

· The property cannot be used mainly for commercial, industrial, business or farming purposes.

· You must apply each year — it is not automatic.

· Most people who qualify can still receive a rebate if they live in a retirement village. We understand from clients that you may need to actively ask (or insist) that the village management process your application.

Information you’ll need to complete the calculator

· Your total rates bill for the year

· Your total household income, including:

· pre-tax New Zealand Superannuation

· interest and dividends from investments (including PIE income and any assessed overseas income)

· overseas pensions

· income from work or rental property

· Proof of income (your tax return may help, but check your council’s requirements)

· The number of dependants living with you

· It’s worth noting that drawings from your investments are not income — what matters is the income those investments actually generate.

Why this is important to you

Many people assume they won’t qualify for a rates rebate — but a surprising number of our clients do, particularly once they’ve retired. With rates continuing to rise, this can make a meaningful difference to your cash flow. Even if you think you’re unlikely to qualify, it’s well worth checking.

The government’s rates rebate calculator is the easiest way to check your eligibility.

Changes to KiwiSaver (Budget 2025)

Since its launch on 1 July 2007, KiwiSaver has become a core part of how many New Zealanders save and invest, and an important part of most people’s long-term financial planning.

It has been a number of years since there were any major changes to KiwiSaver. The last significant ones included the removal of fee subsidies, the halving of the Member Tax Credit (now called the Government Tax Credit), and the removal of the $1,000 kick-start. While there have been other changes over time, those were the ones that had the biggest impact on members.

That has now changed.

As part of Budget 2025, the Government has made a number of adjustments to KiwiSaver, largely aimed at reducing the cost of Government support.

Government Tax Credit (GTC)

The Government Tax Credit is currently paid each year based on contributions made between 1 July and 30 June. It applies to people aged 18 to 65 (with a few adjustments for those who join later in life).

For every $1 you contribute to KiwiSaver during the year (up to $1,042), the Government currently contributes 50 cents, paid into your KiwiSaver account in early July. This means a maximum credit of $521.

From 1 July 2025, this credit is halved. If you are eligible, the maximum Government Tax Credit will reduce to $260.72. In addition, if your income is over $180,000, you will no longer receive the Government Tax Credit at all. All other eligibility rules remain the same.

One positive change is that from 1 July 2025, the Government Tax Credit will also be paid to 16 and 17 year olds.

Contribution rates increasing from April 2026

Another significant change is to contribution rates for people who are still working.

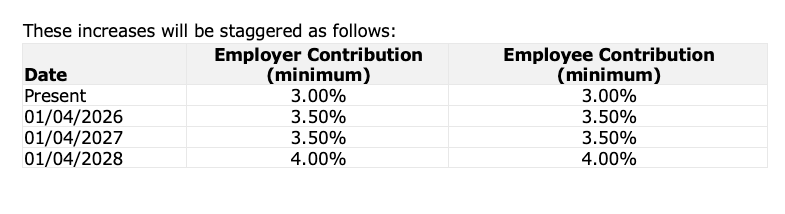

From 1 April 2026, the minimum KiwiSaver contribution rates for both employees and employers will begin increasing from 3% to 4%. These increases will be phased in over time:

These increases will be staggered - see image below:

Employees will be able to apply to temporarily remain at a 3% contribution rate from 1 February 2026 if needed.

In addition, from 1 April 2026, employers will be required to match KiwiSaver contributions for 16 and 17 year olds.

Why is this important to you?

These changes may affect how much support you receive from the Government and how much you are required to contribute if you are still working. For some people, KiwiSaver will become slightly less generous. For others — particularly younger members — it may become more valuable over time.

Either way, it’s important to understand what’s changing so there are no surprises.

We will talk through whether any of these changes affect what you’re currently doing, and whether any adjustments are needed.

Fund Manager Focus – Pengana Emerging Companies Fund

Over the last few years, we’ve been giving you a short overview of some of the fund managers who look after different parts of your portfolio.

The reason we do this is simple. We don’t rely on one way of thinking or one style of investing. Using fund managers who approach decisions differently is an important part of how we build diversification into your portfolio — not just in what you’re invested in, but in how investment decisions are made.

This year, we’re focusing on the Pengana Emerging Companies Fund.

How Pengana invests

Pengana is run by Steve Black (57) and Ed Prendergast (55) — described by Peter as “brains on legs”. They have worked together since 2004, and we have held this fund in our portfolios since 2006, giving it a long and well-established track record.

Steve and Ed carry out the research and make investment decisions jointly. There’s no split of responsibilities — they both know the companies well and are accountable for every decision. Pengana provides the compliance and administrative support around the fund.

The fund invests in smaller listed Australasian companies. In practice, this includes many New Zealand companies, which are small by Australian (and global) standards.

They invest with a long-term mindset, typically looking five to ten years ahead, although companies may be sold earlier if circumstances change. On average, holdings are kept for around two and a half years.

Their approach combines detailed quantitative and qualitative analysis with a very hands-on research process. They spend significant time meeting management teams and visiting companies — often six or seven a week — but only a small proportion of those meetings result in an investment. They are selective, patient and disciplined, and have followed the same core process for many years.

The fund is capped at around $950 million, which helps ensure they can continue investing without diluting their approach. The portfolio typically holds around 60 companies, selected from a much larger universe.

Pengana tends to avoid banking and resource companies and looks for businesses with management teams focused on building long-term value rather than short-term profits. We also worked with them to develop an ESG policy that reflects how they invest in practice.

Why is this important to you?

This section explains why we use different fund managers who think in different ways. Pengana brings a long-term, hands-on approach to investing in smaller Australasian companies, adding another layer of diversification to how your money is managed and reducing reliance on any single investment style.