Investing

We cut through the greenwashing to provide independent

analysis and education to help our

clients invest Responsibly and Sustainably

Our Moneyworks Business Values

Integrity

We do the right thing and have a consistent and uncompromising adherence to strong moral and ethical principles and values. We treat others as we would wish to be treated.

Honesty

We will be clear, factual, truthful, fair and sincere in all our dealings.

Trust

We value your confidence in our ability, judgement and advice and work hard to maintain that relationship.

Genuine

We are authentic. We walk our talk, and let you know the real situation, and mean what we say.

Empathy

We understand our clients' needs and work hard to meet them.

Respect

We treat our clients fairly, considering their feelings, wishes and personal goals and objectives.

Reliability

We do what we say we are going to do and will ensure that we take action for you in a timely manner.

Moneyworks News and Resources

What the Moneyworks team has been up to in our Communities

As a team, we have a number of commitments to our communities (both where we live in Cambridge and also to our professional communities). This is an update on what we have been up to. September 202Read morePurposely Podcast - Why Values Matter in Financial Advice’, Carey Church MD Moneyworks

In November 2025, I was honoured to be invited to talk to Mark Longbottom at Purposely Podcast. The Podcast number was #276, and I listened to quite a few of the podcasts in preparation for myRead moreMoneyworks Festive Season hours

Another year almost finished, and it has been an interesting one. Lets hope 2026 brings better weather for us in New Zealand! Maybe an Indian Summer? We will be finishing work on Friday DecemberRead moreHow does Millie break?

One of the things that can ruin our day is waking up to find out that we have an error message (or two or three) from Millie as she couldn't run the process we were waiting for. To be fair this doesRead moreHow to Outsmart Voice Scammers Pretending to be Family with Safe Words

During our 2025 Annual Review Project with clients, several clients have mentioned that their biggest fear is getting a phone call from their 'child' (which could also be a grandchild), saying thatRead moreWhat do we do to make Millie work?

When we developed Millie in August 2018 we really weren't sure whether she would work, but we were determined from day one that she would be a part of the team. So we developed Millie with anRead moreStewardship in Action - KiwiSaver - Booster

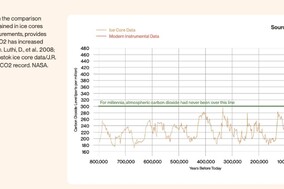

Many KiwiSaver managers in New Zealand pay lip service to Stewardship (in our opinion). Many KiwiSaver managers say that they vote, but based on the publicly available information, they take theRead moreThe Billionaires Playground

Each year in May, my mother and I head up to Auckland to the Auckland Writers Festival (this year was our sixth visit). It is always a sensation overload with all the people and the fantasticRead moreStewardship in Action - Magellan Global

According to Google - this is what Stewardship means: Stewardship refers to the responsible allocation and management of capital to create and preserve long-term value for clients and beneficiaries.�Read moreMeet Saravanan - the brains behind Millie

When we started on our process of building Millie in August 2018 we had no idea what we were doing. We were fortunate that Q4 - a specialist company in Robotic Process Automation (RPA) took aRead moreWe don't just talk the talk, we walk the walk!

We value our relationships with our clients and key suppliers and our role in the community. We have a focus on contributing back to our community as well as doing what we recommend to our clients.

All Moneyworks team members have financial plans in place, incorporating our goals and objectives, KiwiSaver, investment plans along with portfolios and insurance.

All Moneyworks advisers are members of, and Certified Ethical Financial Advisers of Responsible Investment Association Australasia

Our Community Involvement

At Moneyworks we can help you with the following financial advice

We help you get to and through retirement, using ethical investment options, by making your money work and sharing our knowledge.

"I have worked with Carey and Moneyworks for many years now. I value very highly the trusted financial advice Carey provides. It is always timely, tuned for my circumstances and profile, and educational. I very much appreciate this relationship, and this includes the learning founded on rock solid, consistently sound guidance."

Richard Murcott - Wellington

Moneyworks NZ Ltd

P: 0800 225 621

E: contact@moneyworks.co.nz

7c Hall Street, Cambridge 3434

Licensed Financial Advice Provider - FSP 15281

Regulatory Information: Moneyworks is a Licensed Financial Advice Provider (FSP15281), and AML Reporting Entity and is supervised by the Financial Markets Authority.