Last year, when talking about how tricky it is to invest in fossil fuels, one of the reasons that we said it was tricky is because the big fossil fuel companies (think BP, ExxonMobil, Shell, Chevron) have the huge cash inflows that mean that they can commit to investing in renewable energy and research and development, therefore they aren't 'all bad'.

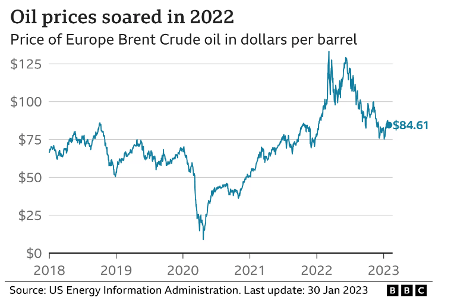

Well, all it took to change that was an invasion of Ukraine and the associated increases in the price of fossil fuels. (See the graph above for the change in oil price.)

In the recent reporting season, it became evident that previous commitments made by the large fossil fuel companies to increase the share of renewable energy (and therefore decrease their impact on Greenhouse Gas Emissions on the planet) were linked to how profitable the sector is, and not necessarily to ‘doing good for the planet’.

The CEO of BP – Bernard Looney announced in February (one day after BP reported record profits) that BP would no longer meet its pledge to reduce oil production and carbon emissions by 40% in 2030 [instead scaling it back to 25%]. This was the same theme communicated by ExxonMobil and Shell, that the profits from searching for an extracting fossil fuels were their core business, now and in the future. It is estimated (by the International Energy Agency) that only 5% of capital investments in the oil and gas sector are in clean energy.

This information was widely reported, but excellent coverage was provided by ‘Leadership Next’ a Fortune and Deloitte podcast and newsletter that I strongly recommend. [Note, BP is still the 'goodest guy' amongst the big oil and gas companies, planning to invest $8 billion into renewables - but also $8 billion into continuing oil and gas exploration. To learn more about what BP are doing as the 'goodest guy' - listen to this illuminating podcast from Fortune - https://fortune.com/2023/02/17/bp-ceo-bernard-looney-energy-transition-carbon-emissions-affordability-security/]

These declarations have focused in on the issue of ‘active engagement’ versus divestment (negative screening). In a quote from Fortune magazine “As Looney said yesterday, oil and gas isn’t going away for decades. Disinvestment by shareholders serves no purpose except to allow investors who don’t care about the environment to earn a higher return. Better to stay in and push for change.”

On the other hand, activist investors (as compared to active investors) are pushing for change and for Shell to be split into two pieces – ‘Green Shell’ and ‘Brown Shell’.

Activist investing can get change slowly and gradually, the option that is available to Moneyworks clients is understanding where your money is invested, and why (if your fund manager chooses to retain an investment in a company like BP) (see notes below)

KiwiSaver Manager justifying why they are holding BP Plc.

Meanwhile, one of the KiwiSaver managers that our clients are invested in, surprised us with their rationale as to why they are holding BP plc. This manager holds themselves out to be an ‘ethical, responsible, sustainable’ manager, but is not one of our core recommendations for clients for ethical KiwiSaver managers. The response was along the lines that ‘we need exposure to energy stocks in our portfolio, and out of the companies, BP is the least bad (and will make a good profit in the future)’.

Unfortunately, as the fund manager is a smaller New Zealand owned fund manager, they don’t have the ability/power to engage in active engagement to get change.

The surprise to us came from the fact that a number of our other fund managers have invested in many other energy companies that have a much lower impact on the planet, and are focused on renewable energy and the transition to net zero. If you are a client who is concerned about the ethical investments in your portfolio, your adviser will let you know if this is a fund that you are currently invested in and recommend a switch to an actual ethical fund manager.

Unfortunately, as the fund manager is a smaller New Zealand owned fund manager, they don’t have the ability/power to engage in active engagement to get change.

For more information check out these links: