How does using an adviser add 5% to your annual returns?

Research recently carried out in New Zealand by Russell Investments, recently confirmed the findings in the USA and Australia, that using an adviser can add 5.2% pa to a clients portfolio returns.

There are three areas that advisers make a difference to their clients investment strategy:

1. Rebalancing (0.4% extra return)

2. Getting it Wrong (2.9% extra return)

3. Avoiding Behavioural Mistakes (1.9% extra return)

In addition, there was the intangible benefit for making investing simpler, but also for financial planning clients, where the investment portfolio is part of a long term strategy of accumulation and then de-accumulation in retirement.

1. Rebalancing (0.4% extra return)

With our Moneyworks clients, we meet with them annually to rebalance their investment portfolio, but any changes needed during the year are carried out in discussion with each client. As well as increasing return, the rebalancing exercise reduces volatility in your portfolio.

“This comes down to advisers having a thorough understanding of their respective client’s goals and risk tolerance as well as the implicit and explicit costs involved. The examples shown, illustrate the value that a disciplined rebalancing approach can add both in terms of risk reduction and return enhancement," the report said.

2. Getting it Wrong (2.9% extra return)

This is about selecting, monitoring, reviewing and making the actual investments. At Moneyworks we spend hundreds of hours researching, interviewing, reading, attending conferences to make sure that we are able to 'get it right' as often as possible for our clients.

The report made the following comments about this area of value add:

"Investing without professional advice can be viewed as an effective way to lower the costs of investing, but this can be a short-sighted and ultimately costly view. For instance, the investor may not set an appropriate investment strategy for their needs, they may lack the skills or time to filter through the many investment options available or they may be tempted to chase performance and over-react to market events.”

"Advisers also provide important access to funds and strategies a client may not be aware of or able to access themselves."

In addition to our combined 58 years of experience in the investment area, Carey, Peter and Paul are continually learning and educating ourselves about the changing thinking and trends in the investment world.

3. Avoiding Behavioural Mistakes (1.9% extra return)

Over the last 23 years, this is an area that we have seen a big impact for our clients, particularly around the GFC. It is human nature to want to pull your investments out when there are headlines in the media about 'crashing' 'freefall' and other sensational headlines about what is happening in the investment markets.

Our education, training and experience enables us to help our clients through those scary times, staying invested, and for them to be able to come out the other side of bad times, still invested, and reaping the rewards of the sudden up tick in the investment markets.

Behavioural mistakes also include chasing past returns, (which can lead to 'buying high' and 'selling low'), going for the newest brightest investment, with bells and whistles, continually chopping and changing your risk profiles and investment strategies. It is our job as your financial adviser to help you understand why these decisions are not necessarily the best option for you at that time.

As the report stated " In practice, we often see investors selling after periods of market volatility, which can ultimately reduce returns and undermine objectives."

On the other hand, it is our job to remind clients how they feel when there are bad times, and to stick with their existing risk profile, when it is tempting to chase higher returns when years are good. It is about knowing our client, and working with each client personally, so that they can sleep at night and not worry about their money.

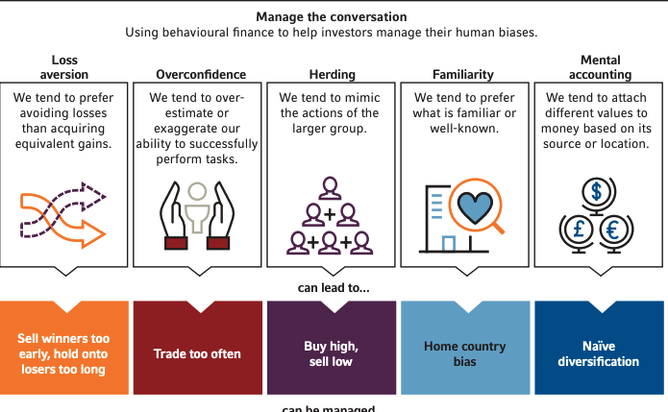

The picture below shows the different types of behavioural biases that can jeopardise your investment strategy, that we are trained to help you avoid.

Summary

While the 5.2% additional return is an average, it is an indicator of how much we can add to you as your adviser - compared to you 'doing it yourself'. Over 2019, I have been clicking a button on many of our clients portfolios to find out how much money we have them 'since inception'. For clients that have been with us for a number of years the amount that we have made after fees and taxes is regularly in the multiple of hundreds of thousands of dollars. Your situation is unique and your advice needs to be personalised.

It really is worth getting financial advice for your strategy. If you would like to talk to us about your situation, email us on contact@moneyworks.co.nz and we will be in touch to discuss your situation.