Coronavirus world, economic outlook and investments.

This is a newsletter that was sent out on Monday May 11th 2020, to Moneyworks Financial Planning and Investment Clients that we work with on an ongoing basis. It has quite a lot of interesting information, so we thought we would share it with you this month.

The fancy free days of attending the Melbourne Tennis Open at the end of January and our annual Portfolio Construction Summit and Finology Conference in Sydney at the end of February seem like a dream right now. It is amazing how quickly we shut down and how quickly the world changed.

At the Portfolio Construction Summit on February 18th, only one of the speakers was concerned about coronavirus – he told us it was a black swan event, and that it would impact on the world economies. But even he only foresaw an impact from restriction of trade from China and the flow on effect of that to trade, commerce and global growth, not the whole world becoming infected and locking down.

I can recall being in Wellington on Monday March 16th, when we had our first coronavirus case from the Australian tourist – and telling clients there would be no hugs – which seemed weird at the time. I continued with my reading, reading, reading and decided at 4am on Tuesday morning to cancel our meetings for the Tuesday and Wednesday and head back home, with fear that I would pick up the virus and infect my 78 year old mum, who lives next door.

It is amazing how much our lives have changed. With Level Two starting on Thursday 14th May and a return to a semblance of what life BC was, this is a good opportunity to review what has happened since my March 17th return to Cambridge, and our country lockdown on Wednesday March 25th.

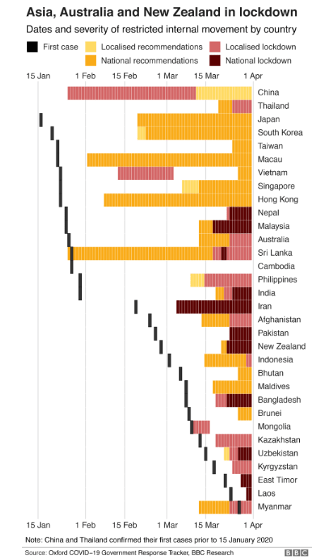

This excellent article from BBC on 7th April has some great charts, showing the impact of lockdown, including this one.

We felt that this was a good time to recap what has happened to the world and your investments and look at the outlook for investments, and any changes that might be applicable for your investments.

For a timeline of what happened – as it is easy to forget, check out this Stuff article - https://www.stuff.co.nz/national/health/coronavirus/121101332/coronavirus-a-timeline-of-the-covid19-pandemic-in-new-zealand-and-globally.

What happened to your investments?

Share markets around the world hit all time highs on the 20th February 2020. Over the weekend following, coronavirus cases outside China surged and the markets started to take the situation seriously. Cases were escalating in South Korea and Italy, and were discovered in the USA. Airline stocks, casino operators and manufacturers which had risks from their supply chains being impacted were the first to fall.

Markets were starting to realise that this ‘black swan’ event might be serious and began assessing the financial impact on a larger range of companies.

These uncertainties and the fear was compounded by the Oil Price war between Russia and Saudi Arabia, when Russia declined to approve OPEC’s proposal to cut oil production (as demand for oil reduced) on March 3rd.

As more cases of Covid-19 were recognised around the world and as companies went into partial or full lockdown, the markets reacted by falling further, reflecting more fear and uncertainty.

Central Banks around the world (Reserve Bank of New Zealand, Australia, Federal Bank USA, Bank of England. ECB etc), reacted by reducing the official cash rates, and releasing more money into the system to support the money supply. RBNZ announced on March 16th that the Official Cash Rate would reduce to 0.25% (from 1.00%) and would stay there for at least the next 12 months. At the time they said ‘The negative economic implications of the COVID-19 virus continue to rise warranting further monetary stimulus.’

In New Zealand, from the 3rd February, we had seen our borders closed to foreign travellers from China, significantly impacting on our tourism and hospitality sectors. The restrictions on trade going in to China had impacted on our forestry and other sectors from early January.

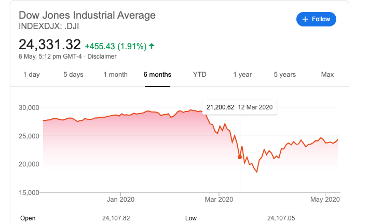

When the WHO declared Covid-19 a pandemic on March 12th, markets fell further. We use the DJIA as proxy for the world markets, you can see how the markets reacted to different events. Pretty much all other markets followed the same trajectory.

New Zealand Government announced the wage subsidy on March 17th (for 12 weeks) to give immediate relief to businesses and their workers.

March 23rd was the bottom of the market falls.

We now know that liquidity around the world seized up at this time, that investors were selling anything that was liquid – whether to pay out withdrawing investors, move to cash or to fulfil margin call requirements (where they had borrowed to invest and had to repay the debts because the markets had fallen so much).

So what happened to turn the markets around?

This is why it isn’t possible to ‘time’ markets. There can be a whole lot of little things that will change the direction of the markets, or just a general ‘feeling’.

Researching what happened on 24th March (in the northern hemisphere) indicates that things were getting worse with coronavirus, and more countries were going into lockdown (remember NZ was 11.59pm on 25th March NZ Time – 24th March Northern Hemisphere), UK announced a 3 week lockdown on the 23rd, the IOC announced the summer Olympics were going to be postponed), in the USA, the politicians couldn’t get their stimulus bill signed off – which should indicate more pain ahead.

On the other hand, the central banks were indicating that they would buy as much debt as necessary to support the economy. This was a big trigger, as it stopped the panic that had frozen the bond markets. Markets moved from worrying about liquidity to fundamentals of investing.

Since then, there has been good news and bad news, but the light at the end of the tunnel (for New Zealand, Australia and some other countries is getting closer.

During the market panic (February 20 – March 23rd) there was a lot of uncertainty about which companies would survive, recover and thrive in the future. Some sectors became very oversold as investors rushed to liquidity, in particular commercial property and infrastructure, as investors were selling ‘anything they could get their hands on’ according to several fund managers.

The professionalism and discipline of the fund managers that we have recommended to you came into action. The communication with their clients (including us on your behalf) has, in general been excellent. They have kept us up to date with what is happening, what they are doing, what they are thinking.

Most of your fund managers had sold investments in late January early February, as their analysis showed that companies were getting too expensive, and they already had cash in their portfolios.

A number of fund managers had enough knowledge and experience to decide to sell assets strategically in the early days, providing them with cash to buy others back later on. As time goes on and the fund managers can see more about the shape of the world (and New Zealand), they are fine tuning their portfolios.

Where are we at now?

Markets have stabilised – and there seems to be more of a semblance of order from the wild swings of mid March. However, some assets have reacted differently because of the kind of crisis that we have, compared to how they were anticipated to react. We have explained our current thinking below.

Are the equity markets at the right level?

We feel that right now (11/05/2020) that the markets aren’t fully valuing in the economic impact of Covid-19 throughout the world.

The markets seem to be optimistic about the future. However, this could be as a result of the volume of money flowing into markets right now (this is the theory of a number of commentators), on the other hand markets usually lead the real economy by a number of months (up to 18 months) and this could be what is happening – the markets anticipating the recovery later in this year or next.

But it does seem that investors are eschewing the bond markets and chasing instant gratification and returns in equity markets. We have seen that in New Zealand with the warning from the Financial Markets Authority to ‘new’ investors.https://www.interest.co.nz/personal-finance/104909/fma-cautions-new-investors-against-piling-nzx-if-they-havent-done-their homework.

Having said that, we can’t identify any trigger (apart from a real war between China/USA or some other players) that would instigate a major sell off from where sharemarkets are right now.

Rather, we see the markets moving sideways for some time –the timing is unknown. The possible outcome of this will be that returns for the next few years or longer will be lower than the returns that we have seen over the last decade.

As Capital International outlined, there have been four phases:

Phase One – Panic, all risk assets sold down indiscriminately

Phase Two – Relief Rally – policy announcements soothed the markets and we started understanding the virus.

Phase Three – Reality sets in. We start to understand the policies, unemployment and the implications for 2nd (and future) waves of infections.

Phase Four – Recovery – a very large dispersion of stock performance and company outcomes – stock picking is key.

It appears that the markets are currently in Phase Three.

What are your fund managers doing?

We have confidence in our fund managers that they are doing their job and analysing all the investments that they hold in their portfolios (or selling investments and holding cash until they have more certainty, and see opportunities to invest), to get the best risk adjusted returned overall for the medium to long term.

We believe that our active managers have the ability to do that, and that we will see some managers (we don’t know which ones at this stage), providing significant outperformance, with others – as usual lagging a little.

There will be winners and losers out of the Covid Crisis, each fund manager has their own perspective on this, but common winners identified are technology, online retailers and healthcare companies.

Identified losers are travel, hospitality, some property (retail, commercial property), some infrastructure (airports, toll bridges). Having said that, the obvious winners and losers have been sold down or bought up, and some may have already been oversold or overbought and could be good buys right now. This is where the value of the extensive research and analysis that your fund managers carry out comes to the fore.

The crisis has accelerated trends that are already happening. These include things like Robotic Process Automation (RPA) – like we have done in building Millie. But also the use of technology in business which some commentators have said has reduced a 2 year projected timeline to 6 weeks, and working from home.

Interest rates

There is global consensus - as well as specific comments from the Reserve Bank of New Zealand that interest rates globally and in New Zealand, are going to stay low for a long time. The RBNZ has committed to 0.25% Official Cash Rate (OCR), for at least a year. This commitment is to provide certainty.

This is an important factor in having the economy rebuild and grow.

This flows through to both term deposits but also to mortgages – we have just seen ASB announce a 2 year 2.99% fixed rate (darn, the day after I re-fixed some of our mortgage for 2 years with ASB for 3.35%).

Income and Dividend Generating companies

In your fixed interest portfolio, we may hold Harbour Australasian Equity Income Fund and/or the Milford Diversified Income Fund. These two funds hold companies where the share price has been hit with the uncertainties over their future income distributions.

More companies will be taking on debt, or using cash reserves, or raising capital to get them through the economic shock. (So far we have seen Auckland International Airport, Kathmandu and today Z Energy do this in New Zealand, and many more in Australia). This means that the companies will be distributing less money, and this will impact the share prices of ‘dividend or income generating’ companies for a while yet.

The fund managers are actively managing the portfolios’ to fulfil the fund’s mandate, and will be selling and buying underlying investments based on their analysis of the outlook.

Infrastructure and Property – not so defensive in this crisis

Traditionally, holding infrastructure and property investments in your portfolio provides stable diversification against market crashes and downtime. This is because infrastructure assets are required for daily life, and good quality property assets have a key role in commerce as well as being attractive because of their consistent revenue.

However, with the sudden changes to the way we live, key infrastructure like international airports and toll roads have suddenly had no traffic and therefore no revenue. Toll roads will have an increase in income as the world gets moving again, as will airports, but the time frame and volume is currently unknown.

Lockdowns have meant people working from home, and retail shops and hospitality premises shuttered. The move back to shopping, going to malls, cinema’s and restaurants will be slow. The move back to working in offices (where people have to wrangle small elevators, and communal open plan offices) will be even slower.

Your fund managers have reported that the landlords in the properties they invest in have been providing rent holidays to a number of tenants, as they understand that a bird in the hand is better than two in the bush. This means lower income for the property owners (you) for a period of time.

Until Australasia is back shopping, dining out and working again, we won’t know the full impact of this reduction in income. There will also be some tenants who do not get back to business, providing vacancies in buildings and therefore lower income streams for a period of time.

What about the economy and life from now?

As you will have heard, there are people receiving the unemployment benefit who have never been unemployed before. There will be pressure on households where there is a lot of debt, even though there is the opportunity to take mortgage holidays (which incur more interest which gets capitalised) and/or interest only mortgage payments.

Spending may be lower, despite campaigns to get us spending, as people realise the value of having emergency cash as a safety net.

Some incomes will be lower, we may have to change our expectations of our living standards – particularly around overseas travel for a long while.

But, over time we will recover, our world will look a little (or a lot) different. Our spending habits may change, we are likely to use technology more and holiday closer to home for quite a while. There will be innovation – some of which we can’t even imagine right now.

We will see Government as a bigger player across the economy for a long period of time. The May 14th NZ Budget will give some guidance as to what this might look like.

Companies are likely to investigate the options of bringing supply chains closer to home, and having more stock on hand instead of ‘just in time’.

Countries have the opportunity to reassess their trade arrangements, while leveraging the uniqueness of their country internationally (a great opportunity for New Zealand).

There are a number of questions that we have including:

a. Will the wealth inequality increase – or does it have the possibility to decrease with Government involvement?

b. Will the gradual move to stakeholder capitalism (taking into account the environment, social and governance factors and not just the financial profit) continue, or will companies revert to their old ways?

c. Will we see any changes to our Health system in New Zealand?

d. Will we see inflation a long way down the track, as a result of supply shortages in individual markets?

e. What will changes to supply chains mean for globalisation – will we see a second cold war - this time between China and USA?

f. Will USA ever regain its’ super power status after this year?

g. What will happen to Brexit, Europe, the UK?

h. What will the impact of a 2nd or 3rd wave be?

i. Vaccine? How long away? How long will it last? Will we have access to it in New Zealand? What will happen with anti-vaxxers?

Recommendations for the current environment

Changes to our investment recommendations in light of Covid-19 are dependent on each clients personal situation including:

a. Your existing asset allocation

b. Whether you are making regular investments to your portfolio

c. How close you are to starting to draw money down from your portfolio

d. What assets you have outside your portfolio

e. What your risk tolerance is and

f. What stage of life you are at.

For many of our clients there is likely to be no particular change.

If you are drawing down funds to live off, then we will sell assets as previously discussed to ensure that there are enough funds to pay your regular withdrawals.

If you are not contributing to your portfolio, we aren’t going to rush to make any changes to your portfolio at this stage, unless something has changed in your situation.

If you are contributing to your portfolio, depending on your situation, we may recommend that you make some changes. We will contact you if we feel that there should be any change.

However, if you want to discuss your portfolio and regular investments, just email your adviser and they will arrange a time to have a discussion with you.

At this stage we do not intend to change any of the investment managers that we use. However, we are continually assessing the fund managers performance (including KiwiSaver providers) during this time, not only in terms of their investment returns, but also in relation to their communication and approach to investment management.

We are monitoring some fund managers that we would like to use, which we may suggest you add to your portfolio in the next year or so.

We may also make some decisions about changing some of your existing fund managers or KiwiSaver provider based on their performance over 2020 and start of 2021 – combined with their approach prior to 2020.

On a final note, we feel that with all the uncertainty and turmoil we have seen both in New Zealand and around the world in recent times, we should also be thankful that New Zealand (to date) has acted quickly and responsibly and we have avoided the worst of what we have seen in other parts of the world.

We have a real opportunity to come out of lockdown quickly and get out of our bubbles and back to work.

At Moneyworks, we intend to support local businesses and markets hit hard by the Covid-19 virus, like travel. We can all do this by buying locally and holidaying in New Zealand as much as we can.

Although the reasons for the recent chaos in financial markets is quite different from what we have seen in the past, the volatility is not, we have been here before on many occasions and each time have come out the other side.'