Looking behind the headlines in the mainstream media

Inflation in New Zealand was recorded at 6.90% pa for the year ending 31st March 2022. This is the highest record of price increases in decades. You may have noticed it when you buy things - like petrol, groceries or imported goods.

When inflation is high, it affects our standard of living and our investments and mortgage rates. People feel worse off. The Reserve Bank of New Zealand has a mandate to keep inflation between 1% and 3%, which they have successfully been doing for decades. The mandate was recently changed to incorporate other factors, which some commentators believe has led to the RBNZ 'taking their eye off the ball'.

The reasons given for inflation being high vary from 'imported inflation because of Covid and the war in Russia/Ukraine and supply chain disruptions' (Government) to 'the Labour Government has flooded the country with money and created all this inflation with their ‘addiction to spending’’ (Opposition parties) and 'there is a tight labour market and high employment' (various commentators).

The commentary below is informed by analysis in Business Desk (subscriber only) and ‘The Kaka – Bernard Hickey (see more information on the special offer for Moneyworks email newsletter readers in separate blog post).

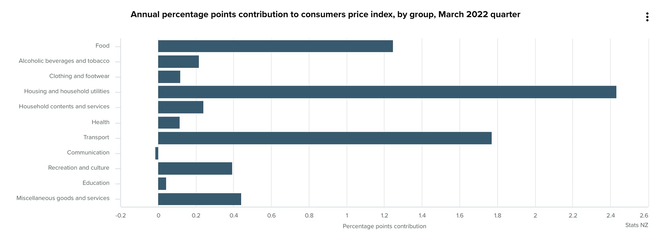

Inflation (technically called the CPI – consumer price index) is created by measuring the cost of 11 groups of goods and more than 100 sub-groups. These different sub groups and groups are weighted differently in the ‘basket of goods’.

Imported or domestic inflation?

Imported inflation (referred to as ‘tradable inflation’) is driven by Transport and Food costs and overall have increased in price by 8.5% in the last year. Transport costs have increased by 18% in the last year, with petrol alone increasing by 32.31% and second hand cars increasing in price by 11%.

Domestic inflation accounts for price increases across all categories of 6%, with housing costs being the largest contributor, with increased costs of 18% for new housing builds

Housing – really?

Yes, really. For homeowners and investors, you will have seen the value of your existing home increase for many years by watching the price on homes.co.nz and oneroof.

Bernard Hickey has calculated that just over a third of inflation last year was generated by the houses we live in or were being built. If housing costs are stripped out of the domestic inflation numbers, inflation was just 4.0% (this doesn’t account for imported inflation.) This category is made up of rent, rates and the cost of building a new house.

As Bernard notes ‘The cost of living in an existing house you own isn’t actually measured, but the new house cost is actually the most important because it is the price set at the margin that then spreads back through rump of the entire stock.’

Housing cost increases had been driven by ‘a whole melange of things’ – Building materials costs, construction worker wages, property developer margins, consenting fees, and a huge lack of supply combined with a surge of demand, starting in mid 2020 and reaching a crescendo in late 2021.

Extra demand and low supply pushes prices up – the first thing that economics students learn.

This was combined with the prolific and easy supply of money at very low interest rates (which is the responsibility of the Reserve Bank). While the Government can’t tell the RBNZ what to do,, the Government signed off on the money printing and the removal of the Loan to Value Ratios (LVR’s) that powered this easy and cheap availability of money.

See inflation graph above.

What about all that extra money and ‘addiction to spending’?

Hickeys commentary again ‘The bulk of the $20b in cash ‘splashed out’ in 2020 and 2021 went to businesses and households with business and property assets, not consumers directly.

That money resulted in higher profits for some businesses, more leveraged investment in property and higher cash deposits in banks.

Both National and ACT supported the spending of that $20b in wage subsidies and resurgence payments, along with the several billion dollars in specific support measures and investments in freight subsidies and tourism supports.’

Labour costs (wages)

The minimum wage in New Zealand has increased to $21 an hour from 1st April, and this has a cascading flow on effect to what other people are paid – to keep the ‘reward’ ratios intact.

As well as minimum wages increasing, benefits (including New Zealand Superannuation) have increased from 1st April.

The closed borders for two years has resulted in many industries not having enough workers (from fruit picking to software development). With the borders opening, it is estimated that New Zealand will lose more than 50,000 people overseas (mainly Australia and mainly skilled people), to higher wages.

Anecdotally, core wages aren’t increasing by the same amount as inflation, but employers are using one off retention, profit share or other bonuses or payments to retain staff.

If wages start increasing in reaction to the scarcity of workers, the borders opening and the higher cost of living, this could feed into a cycle of higher costs, higher wages, higher costs – as businesses fight to retain their profit margins.

Structural impacts on low inflation over the long term

High inflation is not necessarily here to stay.

A big contributor to low inflation in recent years has been the move to using technological platforms and the cloud for business. Having an app that can do the work for you for $100 a month in the cloud, as compared to a desk top based programme that costs $550 a month (real life example for Moneyworks Client Relationship Management (CRM) system, has led to reduced costs of business across the board.

These reduced costs have led into greater profitability for business and therefore prices remaining stagnant (instead of increasing), or reduced prices in some areas.

SummaryThere are a few pointers to pick up from this article:

- Mainstream media headlines and articles don’t always tell the full story, it is worth reading in more depth in specialised news resources to fully understand what is happening.

- There is a long term structural change to technological solutions that directly impacts on keeping inflation low. It is anticipated that inflation will return to within the 1-3 range by the end of 2023 as long as we don’t get into a cycle of wage inflation/price inflation.

- New Zealanders love of property (and investing in property) and the high demand and low supply have been strong drivers of the current 6.9% inflation rate (combined with imported transport and food inflation).

- It is important to understand how this impacts on your investments and to ensure that you have a robust retirement plan to understand how your money will last in retirement