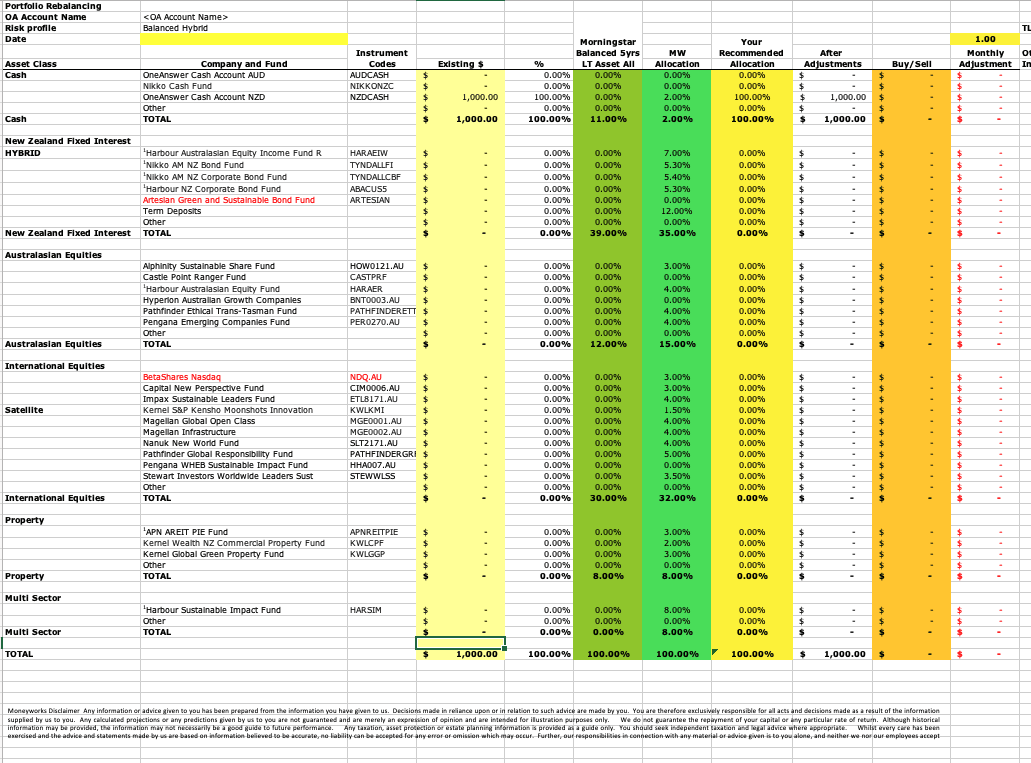

Model Portfolios

We have 9 model portfolios (three each for each risk profile of Conservative, Balanced and Growth). If a client's risk profile is Defensive (in general) we do not work with them and recommend that they leave their funds in the bank, and for an Aggressive client we use the Growth Model Portfolio as a base and personalise the recommendations.

For each of those risk profiles we have three types of portfolio - Ethical, Hybrid and Base as outlined below.

Ethical Portfolio incorporates negative and norm based screening, but focuses on Positive Screening and where feasible adds some Impact Investing options (limited options because our portfolio's need to be liquid). 25% of our client portfolios (around 15% more are transitioning to this portfolio over the next year or two)

Hybrid Portfolio is based on negative and norms based screening, and adds in some Positive Screening and Impact investing, but also includes 2-3 fund managers who do not define themselves as 'ethical' but where their processes and systems and active engagement and stewardship with their investee companies means that the actual holdings meet our minimum criteria for holding in this portfolio.

71% of our client portfolios

Base Portfolio This is the old portfolio that we used before transitioning clients, is not available to new clients and is held by only 4% of our clients (which are clients who self manage their investments or who are ending the term of our relationship with them.)

4% of our client portfolios

We rolled out the ethical investment offering to our clients in calendar year 2022 and some clients are still transitioning to their desired portfolio, so have some investments that don't fully match the model portfolio yet.

Moneyworks NZ Ltd

P: 0800 225 621

E: contact@moneyworks.co.nz

P O Box 1003, Cambridge 3450

Licensed Financial Advice Provider - FSP 15281

Regulatory Information: Moneyworks is a Licensed Financial Advice Provider (FSP15281), and AML Reporting Entity and is supervised by the Financial Markets Authority.