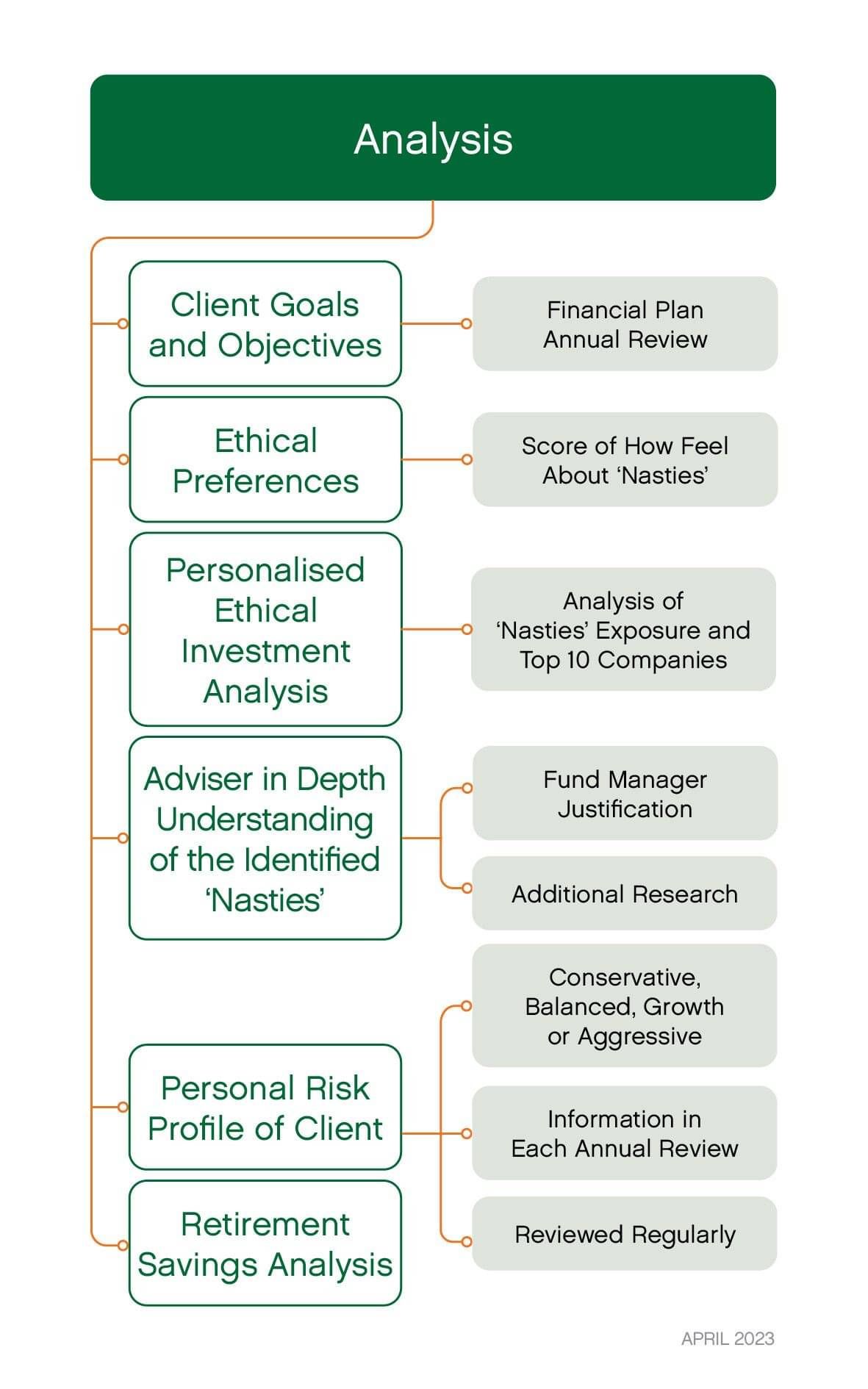

Analysis

Our six branches of Analysis

As well as offering ethical investment advice, Moneyworks helps our clients get to and through retirement.

With Education being a cornerstone of our offering, we need to understand what we are investing in, what the investment and financial planning environment is like and how it will impact on each individual client.

And, of course we need to know our clients, understand where they are at, where they want to go and also, where they have come from. Providing ethical investment advice has helped us know our clients at a deeper level with the discussions about values that we are having with them.

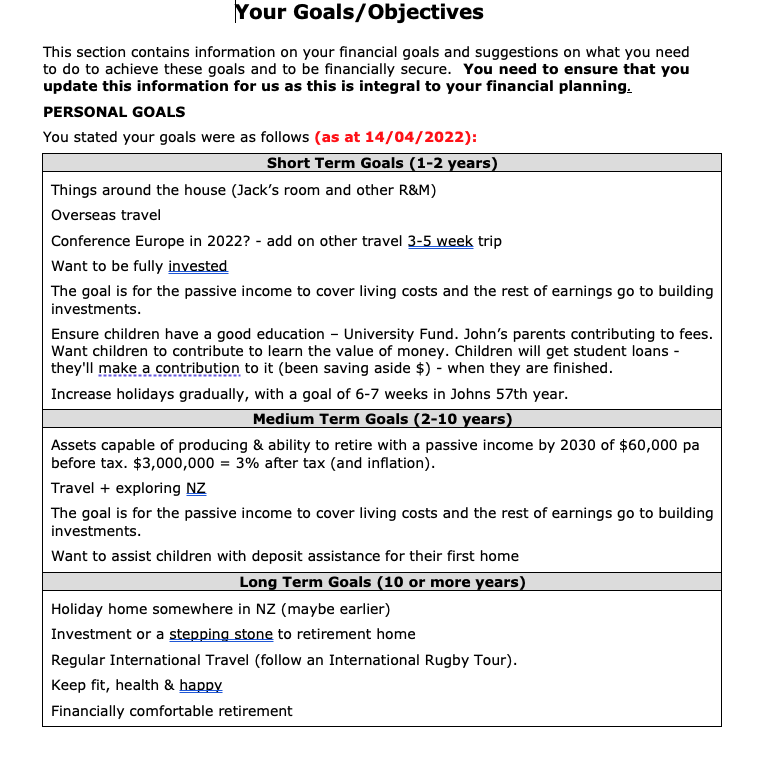

Client Goals & Objectives

Why do we get these updated every year?

When we start working with a client we have extensive discussions with them about what they want to achieve, and where possible we quantify those (put a $ value next to them.)

We then update these every year at our Annual Review meeting. We tell them what their goals were in the previous year and we go through the list and tick off what has been achieved and adding any new goals.

We also update our clients financial arrangements annually, that Moneyworks doesn't manage (eg bank accounts, term deposits).

These two key exercises help us get a feel for how much the clients are spending now - which is a key factor in developing the personalised Retirement Savings Analysis - see below, but also in ensuring that money is properly allocated for each project. It is important that we understand what is happening in our clients life to help them to achieve their goals.

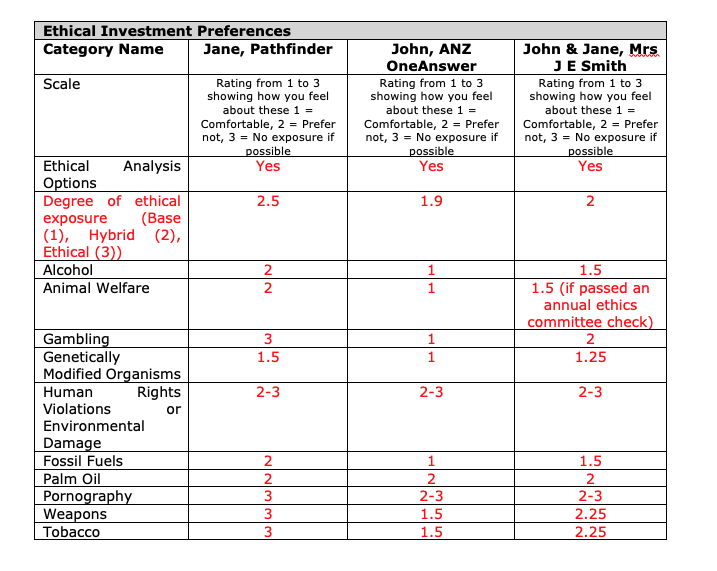

Clients Ethical Preferences

Understanding our clients values and ethical preferences

Some of the most valuable discussions that we have with our clients are about their ethical preferences. We have developed our own fact find, based around the Mindful Money identified 'nasties' - see the example to the left.

We ask our clients to score on a scale of 1, 2 or 3. 1 means that they are comfortable with their exposure (a number of people choose this for Alcohol saying they would be hypocritical to say otherwise). 2 means that they would prefer not to have an exposure and 3 indicates no exposure if possible. Even some of our die hard 'I'm not interested in ethical investing' choose 3 for Human Rights and Environmental Violations.

We record these for each person and either average the scores for joint investments, or get a score from the client for their joint or trust investments. This leads in to the type of investment portfolio that is appropriate for them, whether it be not ethical (base - but not offered to new clients), Hybrid or fully ethical.

These categories will be updated and clients scored refreshed when Mindful Money changes categories.

Proprietary Personalised Ethical Investment Analysis

Cutting through the greenwashing

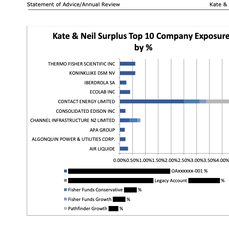

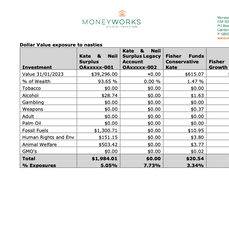

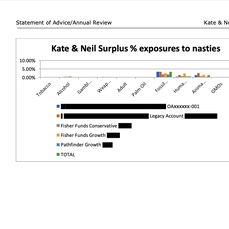

This reporting is the key that enables us to have confidence in our claims that we provide clients with Ethical investments. Using the Mindful Money research and combining it with the data crunching ability of our robot Millie, we are able to provide a personalised report for each client in their financial plan and each annual review, showing what 'nasties' they have available to them.

This works in conjunction with our education to build their ethical investing approach and enables us to tailor portfolios if for example a client is adamant that they don't want any exposure to weapons (which has happened).

An anonymised copy of an analysis from this years annual review is available on the right for you to download, and the photos show the kind of graphs and tables that deliver the message.

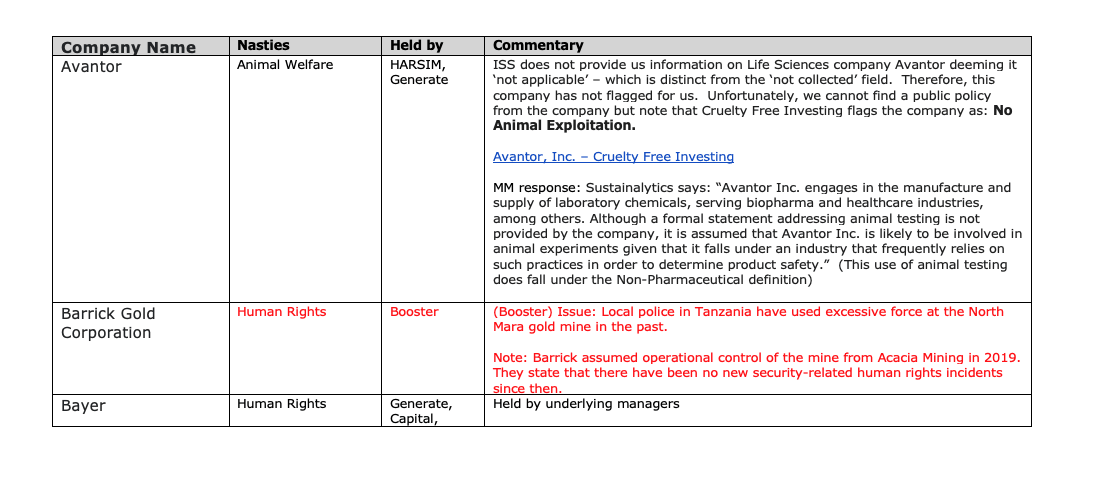

Adviser in-depth understanding of 'nasties'

We need to be able to explain these 'nasties' to our clients, so we need to understand in-depth

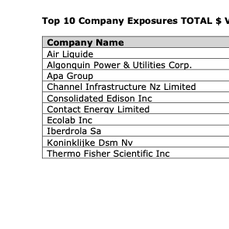

After the personalised ethical investment analysis for each client we have a full list of their 'nasties' and $ and % exposure - we report by category and the top 10 companies, but the information is available for us answer any clients queries. We have had questions relating to wanting no exposure to weapons, Amazon and DGL to name a few and were able to tell the clients exactly what their exposure is.

Whilst we report on the top 10 companies in the annual review and financial plan, we believe that we need to understand these in more detail ourselves.

We seek information from our fund managers on their justification for holding these 'nasties', to go with the information from Mindful Money and our own research.

We track this in a (currently 57 page) document, adding the information from different sources as a quick reference to be able to answer questions and for our own knowledge. We have added a screenshot to the left.

Retirement Savings Analysis

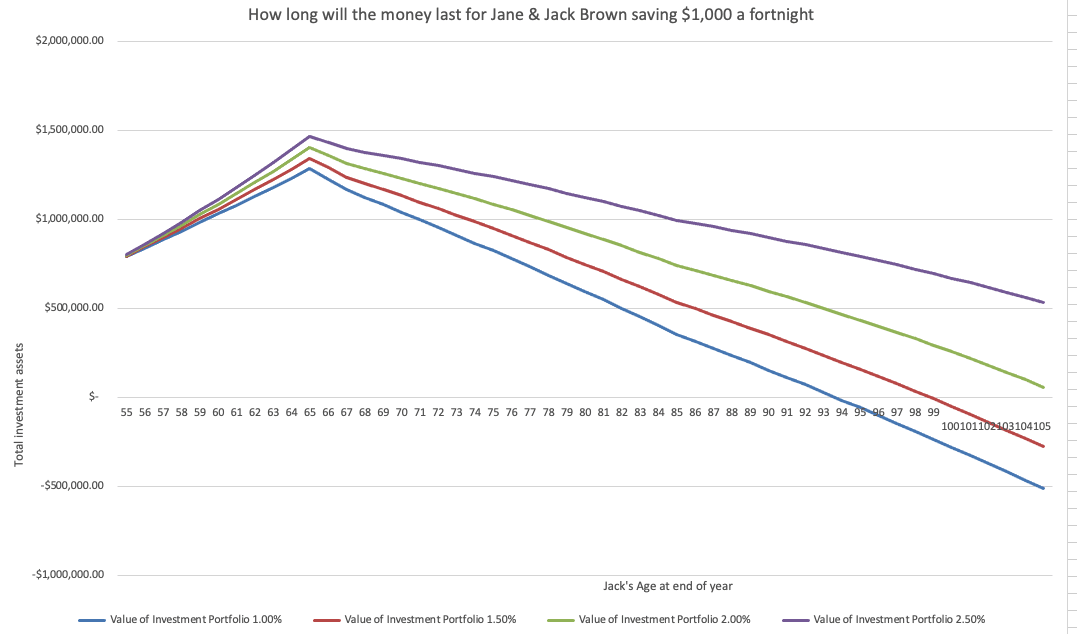

A personalised Retirement Savings Analysis for each client to show 'how long will the money last'

This in-house built analysis provides a framework for clients to see how they are track to achieve their goals. For younger clients who still have debt, this starts off as a Cashflow analysis and tracks when the mortgage will be repaid and how much will be saved towards retirement.

For the bulk of our clients the analysis is the Retirement Savings Analysis, which shows 'how long will your money last' depending on how much they save, spend and based on four after tax, inflation and fees returns of 1.00%, 1.50%, 2.00% and 2.50% pa.

We educate our clients about the role of inflation and focus them on the returns that they need to achieve their goals. As clients get closer to retirement, this analysis is updated every year, so that they can have reassurance that their money will last (or that they have to spend less, save more or work longer if they haven't saved enough).

Although there is quite a bit of work and assumptions included in the analysis, most clients are really just interested in the graph (shown on the left) to see when the line intersects with the horizontal access, which is when their money will run out. The amount spent and saved are variables that the clients can change themselves to look at different scenarios.

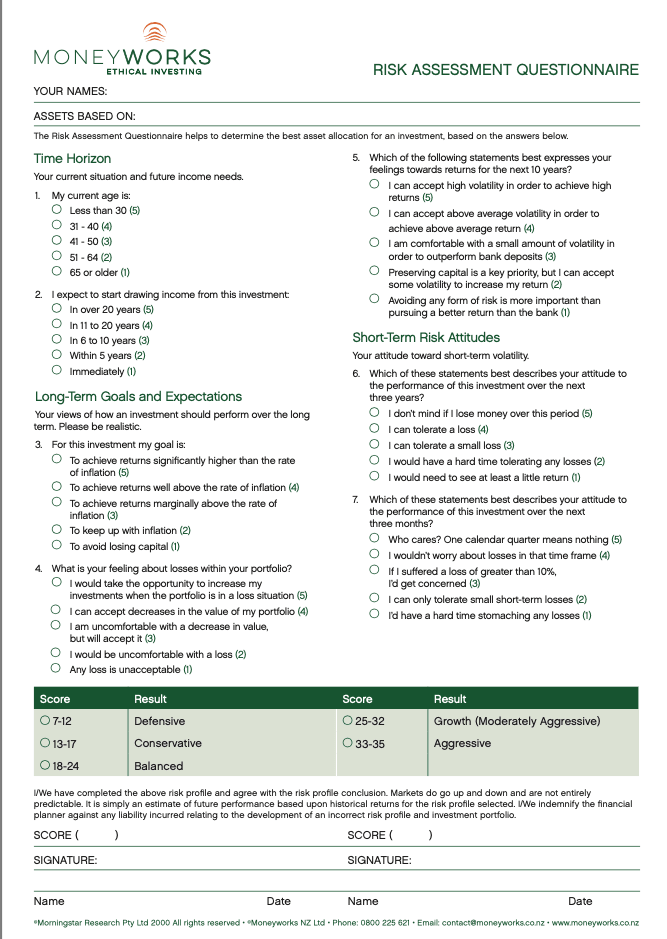

Personal Risk Profile

Understanding clients risk tolerance

We use a one page analysis to start the conversation with the clients about how much risk they can tolerate. This provides us with information about whether a client is a Defensive, Conservative, Balanced, Growth or more Aggressive investor.

We don't take on Defensive investors, we recommend that they leave the money in the bank. We have model portfolios for the middle three risk profiles and we adapt the Growth risk profile for personalised advice for the small group of more aggressive investors, or where we are only managing the equity component of their assets.

The annual review document has two sections reminding clients of what this risk profile means and we review clients risk profile if their situation changes and from time to time as is applicable.

Moneyworks NZ Ltd

P: 0800 225 621

E: contact@moneyworks.co.nz

P O Box 1003, Cambridge 3450

Licensed Financial Advice Provider - FSP 15281

Regulatory Information: Moneyworks is a Licensed Financial Advice Provider (FSP15281), and AML Reporting Entity and is supervised by the Financial Markets Authority.