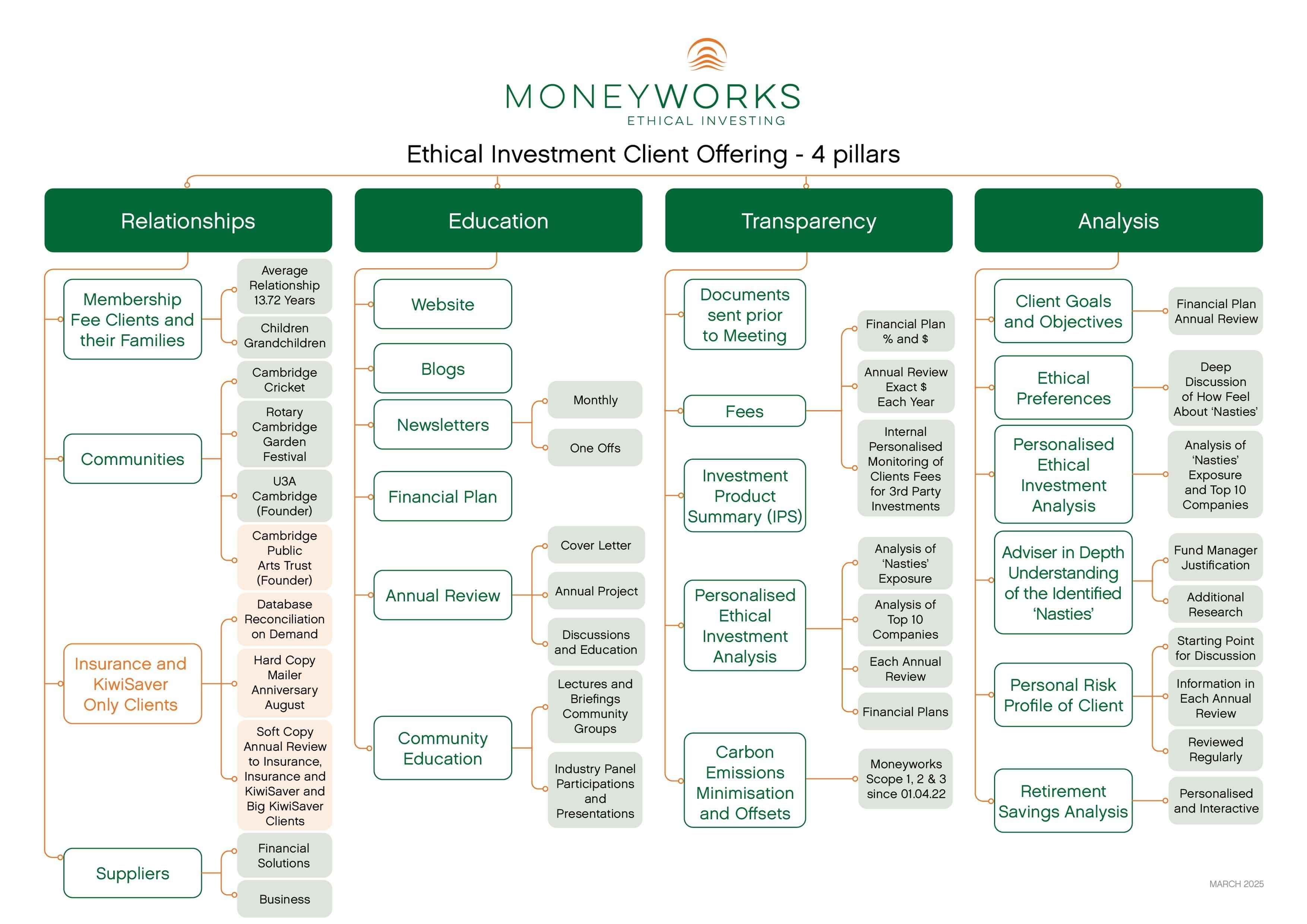

Moneyworks Ethical Investment Client Offering - 4 Pillars

The Moneyworks Ethical Investment Client Offering has been developed since 2020 and is continually evolving.

Relationships are the key to any financial advisers proposition. Moneyworks clients are younger than the average financial planning/investment advisory business by about 10 years (61.20 years is our average age). When Moneyworks was established we targetted people who were accumulating their wealth, which meant a slow build of their wealth, along with the development of our relationship with our clients. Our average length of relationship with our clients at April 2024 is 13.72 years, which means that we have seen our clients grow and develop, watched their children grow up, grandchildren arrive, and understand how they engage with their work, community and whanau.

Given the young age of our clients, in recent years we have begun working with a number of our clients children, who are young professionals, with our clients encouraging their children to get develop and build a financial planning relationship from a young age.

Our relationships with our financial services providers are important to us, and we work to understand what they are doing, and to have a two way relationship. We assist a number of our financial service providers with understanding the financial adviser world, how we work, what is important and also educate them on historic events (like the launch and development of KiwiSaver), where they may not have had experience and knowledge.

Our day to day operational relationships are also very important to us, and we act as a mentor to a number of our business services providers, developing long term mutually beneficial relationships.

In addition to our relationships, the core Moneyworks client proposition since 1997 has been based on education, to ensure that our clients fully understood (to the extent that they wanted to) what we were recommending and talking to them about.

Our other two pillars are Transparency and Analysis.

We are very proud of our transparency with respect to fees and costs (which we understand is unique in New Zealand). Not only do we fulfil our regulatory requirement to disclose fees and costs at the start of any engagement in % terms, since 2012 we have declared this information in $ terms as well. But we go further than that by declaring the actual $ income that we have received from each of our Membership Fee Clients every 12 months in their annual review (which we have also been doing since 2012).

Since 01/04/2022 we have offset all of our Scope 1, Scope 2 and Scope 3 carbon emissions. Our Scope 1 and Scope 2 emissions are minimal, and we monitor, report and offset our remaining Scope 1 and 2 emissions and all of our Scope 3 emissions through Carbon Trail.

Nasties disclosure and transparency

One of the concerns that we had about holding ourselves out as Ethical Investment Advisers was that a 'non-ethical' investment would sneak in to the portfolios and we would be letting our clients down.

We were delighted to discover the Mindful Money research shortly after it launched and approached them to undertake the research on our recommended investments for a fee. Since that time we have used our in-in-house robot - Millie to build a deeply analytical data analysis so that we can provide each client with a personalised ethical investment analysis which shows how much exposure they have (to the cent) to identified 'nasties'.

These 'nasties' are companies of concern that have been identified through the Mindful Money research process, with consumer research establishing the 10 'nasty' categories. We find that the word 'nasties' is an effective shortcut for explaining these to clients, even though some companies (eg L'Oreal) are actually doing a lot of good in the area where they have been tagged as a nasty.

We have divided our client offering into the four pillars and by clicking on the button below it will take you to more information on each pillar.

Relationships

Transparency

Moneyworks NZ Ltd

P: 0800 225 621

E: contact@moneyworks.co.nz

P O Box 1003, Cambridge 3450

Licensed Financial Advice Provider - FSP 15281

Regulatory Information: Moneyworks is a Licensed Financial Advice Provider (FSP15281), and AML Reporting Entity and is supervised by the Financial Markets Authority.