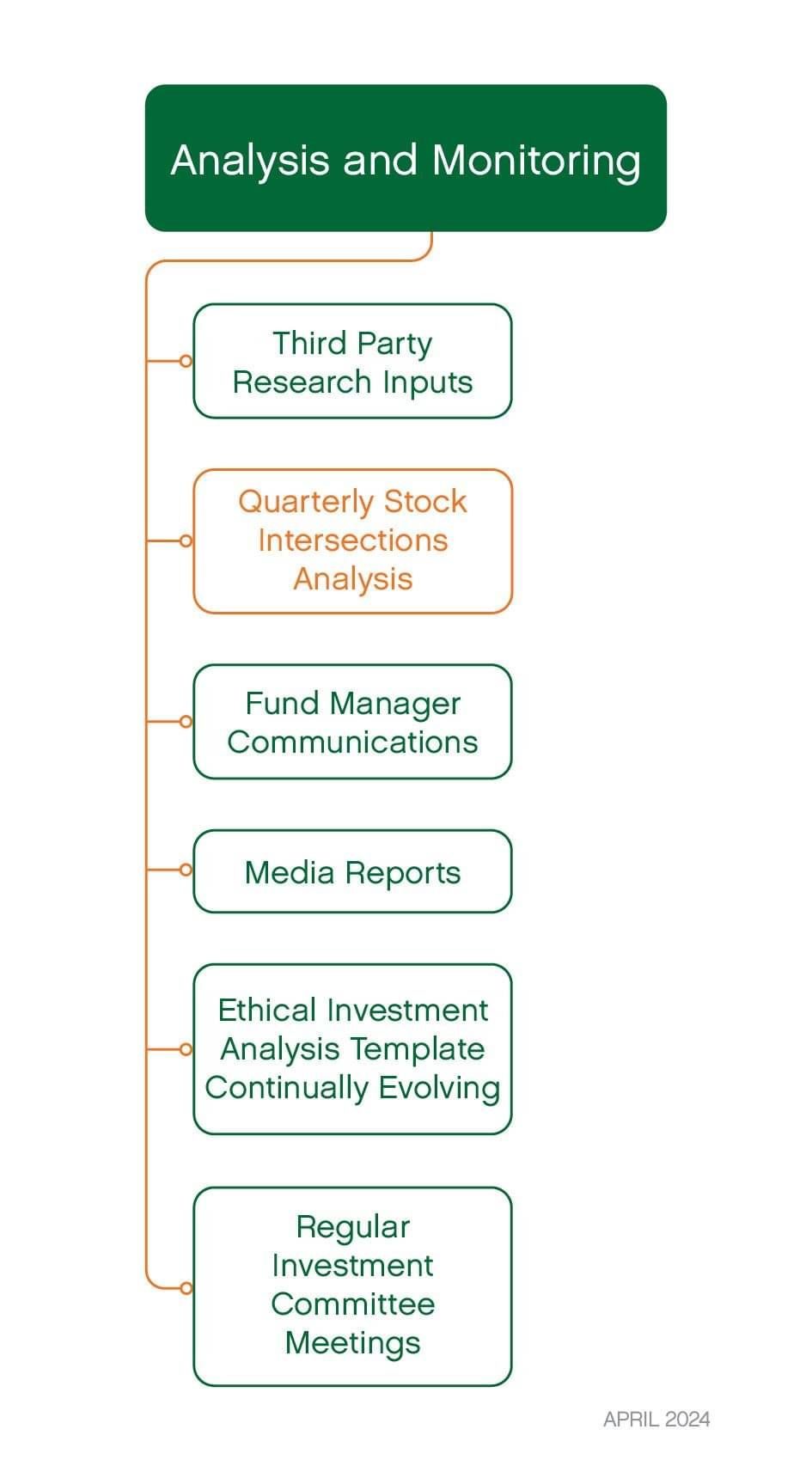

Analysis & Monitoring

As we know the world is continually changing, evolving (and sometimes devolving) and this applies to our clients personal situations, the fund managers we work with and their underlying investments.

Analysis and Monitoring of the investments that we recommend to our clients is a core part of our work. This incorporates being aware of new offerings that might be a better option for our clients than existing options, as well as understanding the regulatory and legislative environment that our fund managers operate in. [For example, we exited one of our small fund managers over 2023 because of the regulatory risk signalled from the FMA in relation to small fund managers].

We have summarised the work that we do in this pillar into five branches as outlined below.

Third Party Research Inputs

We subscribe to a number of third party research providers, which all have a particular use for our analysis and monitoring. Through these subscriptions we monitor changes and alerts, and when we do an ongoing monitoring review we include any up to date information from these inputs.

Morningstar, monthly investment performance analysis information, plus alerts on changes to funds.

Lonsec - In depth and detailed research reports on funds and fund managers.

RIAA Certification - as a validation check.

Mindful Money 6 monthly updates - monitoring the 'nasties', additions and deletions for our recommended fund managers.

Quarterly Stock Intersections Analysis

Using our data crunching robot, Millie, we access information quarterly on all of the funds being monitored and recommended. We have agreements with all our fund managers that this information is confidential and used in-house for our purposes.

The process has four main outputs:

What has changed in the fund managers portfolio in the last quarter - enabling us to understand what is happening and how the fund manager is adding value (or not).

After de-duplicating information (as fund managers call the same company different things, eg National Australia Bank could be NAB or Nat. Aust. Bank), Millie prepares worksheets for us to use to look at the actual holdings of the fund managers that we are analysing.

We then manually compare the holdings of different fund managers in our investment committee meeting. Our goal is to ensure that we aren't just duplicating the same fund over and over again.

This analysis ensures that our Fund Managers are adding value through diversification and that our active fund managers aren't benchmark hugging.

Millie compares the added, deleted, increased and decreased holdings to the list of nasties from the last Mindful Money analysis, and updates the master worksheet that is used in the personalised analysis for clients, while alerting us to the changes for our information.

Fund Manager Communications and Presentations

Most of the fund managers that we recommend have a commitment to education of advisers and investors.

We consume their offerings by reading, watching and participating. These offerings include:

Newsletters and Fund Updates

Annual Impact Reports

Webinars

Presentations (roadshows etc)

Media Reports

As a team we subscribe to a wide range of media that updates us on happenings with fund managers and underlying 'nasty' companies.

These include - but are not limited to:

Financial Times (and FT Moral Money)

New York Times

Livewire blog

Investment News

Newsroom

Business Day

The Kaka

NZ Herald

Stuff

Plus many other daily and weekly newsletters.

Internal Regular Investment Committee Meetings

Our investment committee is made up of all three of our advisers, Carey Church, Peter Church and Paul Swarbrick. Both Carey and Peter have had extensive experience as part of investment committees and Paul brings commercial finance experience and 10+ years as an adviser to the committee.

We meet as required, but a minimum of twice a year.

For example, from August to December 2022 we undertook an in-depth analysis of each fund manager recommended using the Internal Stock Intersections Analysis. This resulted in some changes to our model portfolios.

We meet after major investment conferences and major events and as required to review our strategy, macro views and model portfolios.

We also meet with for regular Business Meetings and an annual internal Audit Meeting, and there are often investment related topics discussed in those meetings.

Moneyworks NZ Ltd

P: 0800 225 621

E: contact@moneyworks.co.nz

P O Box 1003, Cambridge 3450

Licensed Financial Advice Provider - FSP 15281

Regulatory Information: Moneyworks is a Licensed Financial Advice Provider (FSP15281), and AML Reporting Entity and is supervised by the Financial Markets Authority.