Scroll to the bottom of the page and click on the relevant box to find out more about each stage of the process

Moneyworks Ethical Investment Process

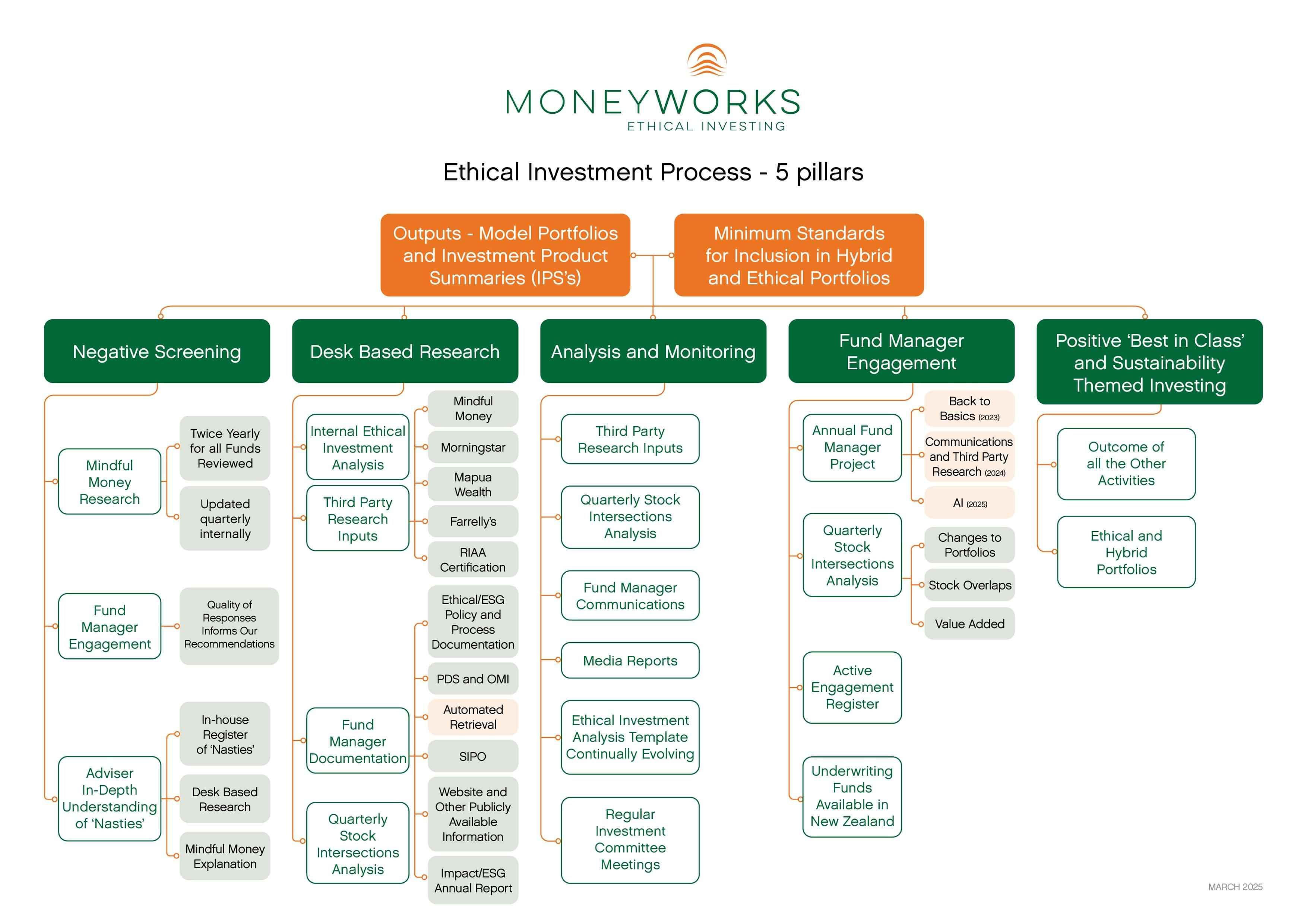

Our Ethical Investment Options Process is our only Investment Policy and Process and has been developed and improved since 2020. There are five separate pillars - and more information is available on each pillar by clicking on the relevant box below.

The OUTPUTS from this process are our Model Portfolios and our Investment Product Summaries and Ethical Investment Analysis (each is outlined in more detail below)

The full Ethical Investment Analysis Policy and Process Manual is available for you to download from the button below, but it is a long and detailed document so we have summarised the information on these web pages to make it easier for you to access.

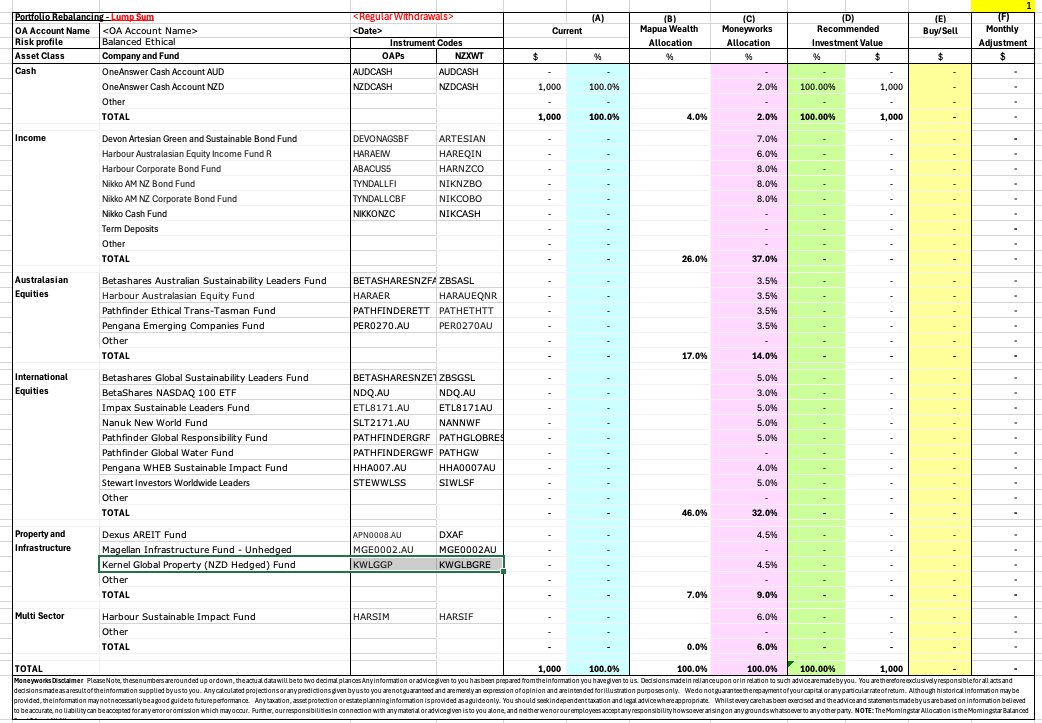

Model Portfolios

We have 6 model portfolios (Hybrid + Ethical, with one for each risk profile of Conservative, Balanced and Growth). If a client's risk profile is Defensive (in general) we do not work with them and recommend that they leave their funds in the bank, and for an Aggressive client we use the Growth Model Portfolio as a base and personalise the recommendations.

For each of those risk profiles we have two types of portfolio - Ethical and Hybrid as outlined below.

Ethical Portfolio incorporates negative and norm based screening, but focuses on Positive Screening and where feasible adds some Impact Investing options (limited options because our portfolio's need to be liquid). 25% of our client portfolios (around 15% more are transitioning to this portfolio over the next year or two)

Hybrid Portfolio is based on negative and norms based screening, and adds in some Positive Screening and Impact investing, but also includes 2-3 fund managers who do not define themselves as 'ethical' but where their processes and systems and active engagement and stewardship with their investee companies means that the actual holdings meet our minimum criteria for holding in this portfolio.

71% of our client portfolios

Base Portfolio This is the old portfolio that we used before transitioning clients, is not available to new clients and is held by only 4% of our clients (which are clients who self manage their investments or who are ending the term of our relationship with them.) 4% of our client portfolios. This is NOT available to new clients.

We rolled out the ethical investment offering to our clients in calendar year 2022 and some clients are still transitioning to their desired portfolio, so have some investments that don't fully match the model portfolio yet.

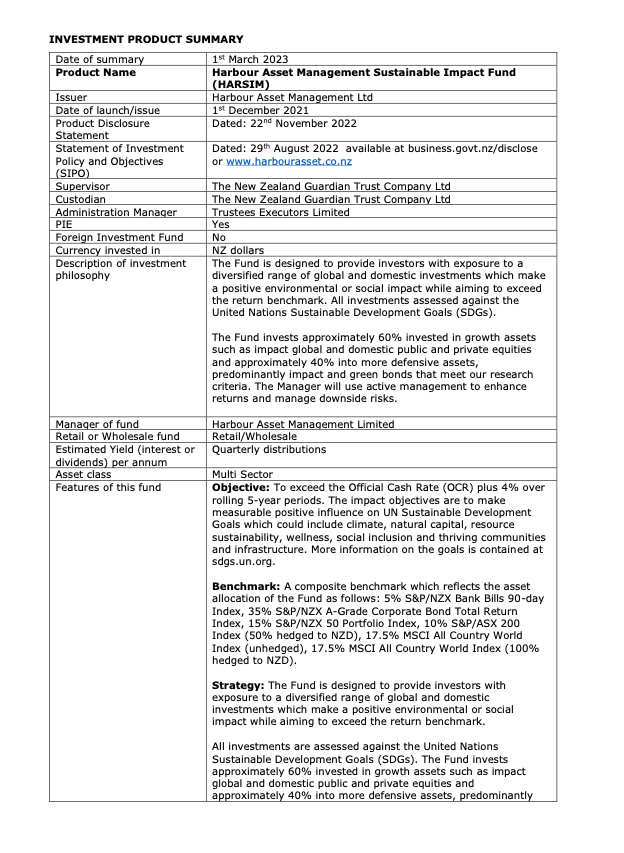

Investment Product Summary (IPS)

This is an internal document that we have prepared for our clients since 2010. This document summarises all the important things that we need our clients to know about the funds that we are recommending (particularly important following the changes to the PDS which only have proscribed information).

These were originally provided to clients at each annual review in hard copy, then on a CD Rom, then a USB Stick (still provided in new Financial Plans) and now at annual reviews by a Google Drive link.

This information includes the fees charged by the fund manager, any rebates that our clients receive, the fund sizes, the risks, and why we recommend the funds.

We aim to update these when PDS and material information is updated and are currently working on a process to automate these updates to have as up to date information as possible.

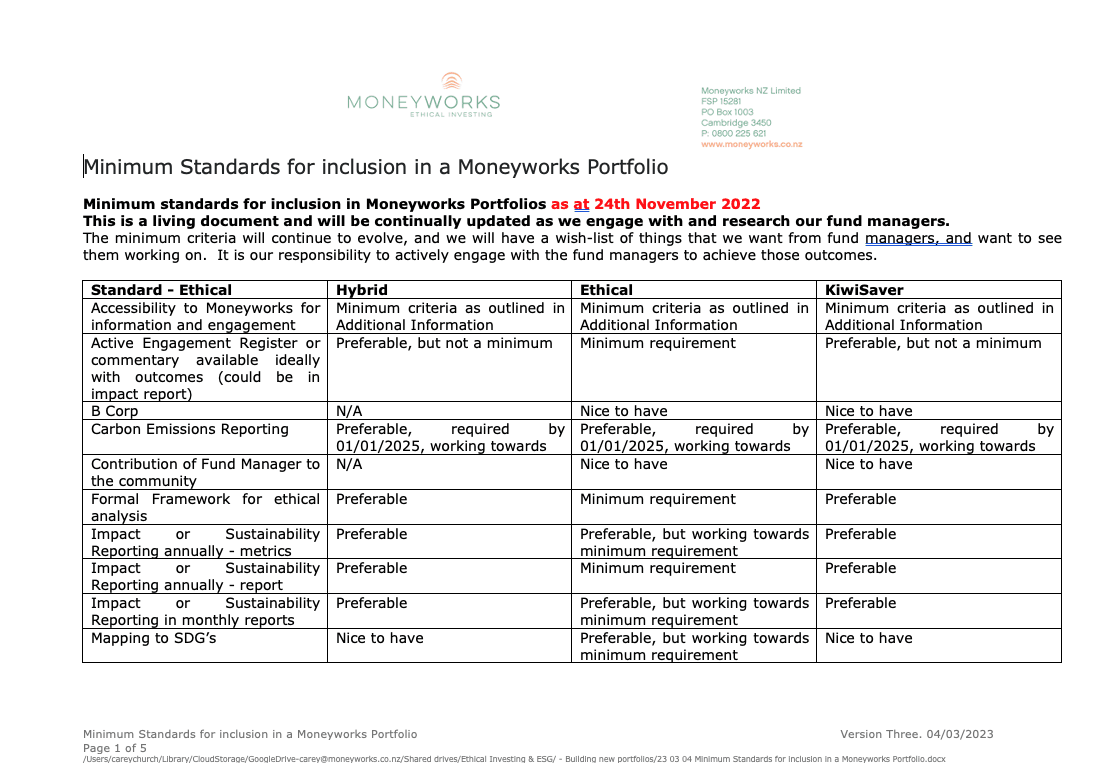

Minimum Standards for ethical investing

We have developed our minimum standards/criteria for our Hybrid and Ethical Portfolios and KiwiSaver providers. The document on the right is our first final version, but they will change as the environment and Mindful Money methodology alters.

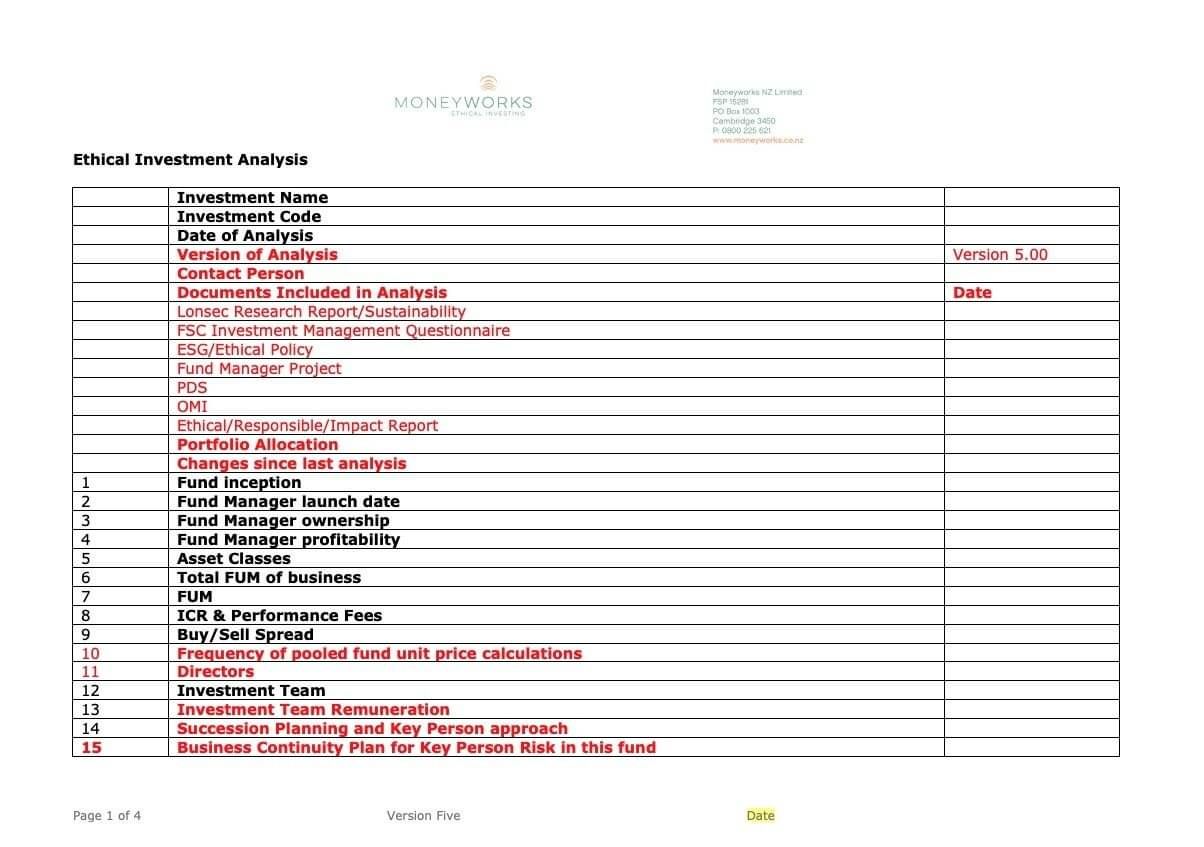

Ethical Investment Analysis - Internal

This 68 question ethical investment analysis is the core of our initial research into a fund manager and incorporates information from all sources outlined on the buttons below.

Starting with Desk Based Research incorporating Third Party Research, Fund Manager produced information, Publicly Available information on the Fund Manager and buttressed by the Negative Screening results from the Mindful Money Research, the Ethical Investment Analysis highlights the issues, features and any concerns that we may have about a fund manager.

We aim to update these analyses after the annual fund manager project is completed.

Negative

Screening

Desk Based Research

Analysis and Monitoring

Fund Manager Engagement

Positive Best in Class and Sustainability

Moneyworks NZ Ltd

P: 0800 225 621

E: contact@moneyworks.co.nz

P O Box 1003, Cambridge 3450

Licensed Financial Advice Provider - FSP 15281

Regulatory Information: Moneyworks is a Licensed Financial Advice Provider (FSP15281), and AML Reporting Entity and is supervised by the Financial Markets Authority.