Cutting through the Greenwashing

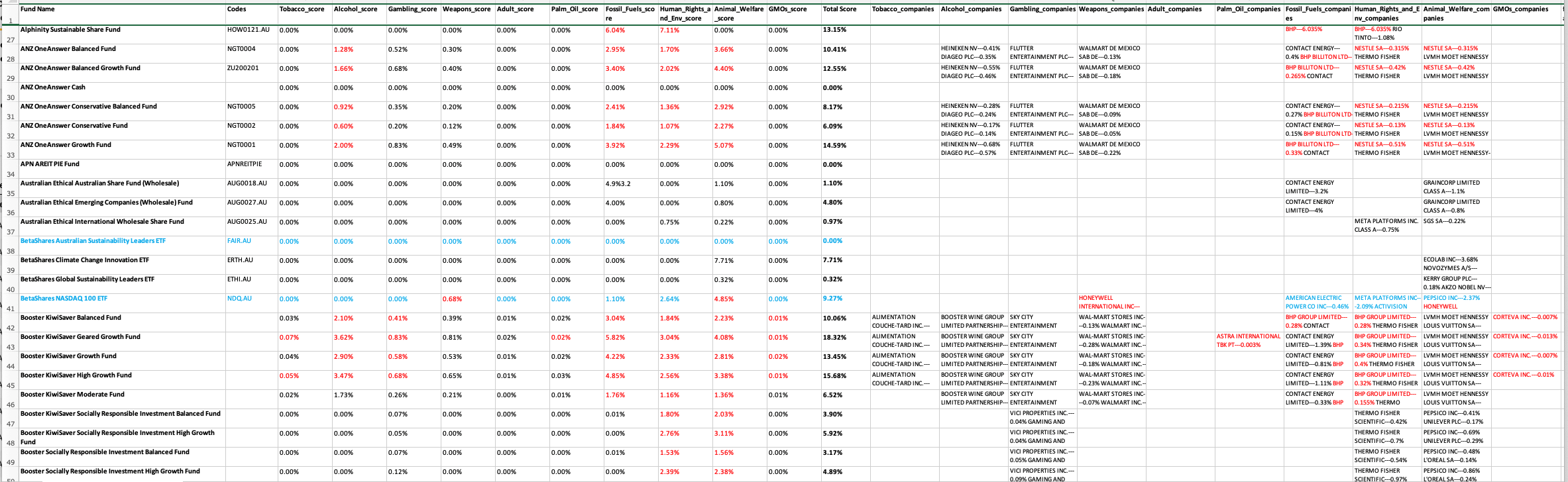

Access to the Mindful Money research identifying 'nasties', combined with our robot Millie's ability to do major data analysis tasks for us, means that we can provide our clients with personalised negative screening for their investment holdings.

In addition, the information allows us to see whether fund managers are actually 'walking the talk' and to engage with our recommended fund managers about decisions that they have made that ethically may not be what our clients are after.

With our Quarterly Stock Intersections Analysis Process , from the start of 2024, we are able to update the known 'nasties' internally, if they are added, increased, reduced or deleted from our fund managers holdings, providing clients with updated information each quarter.

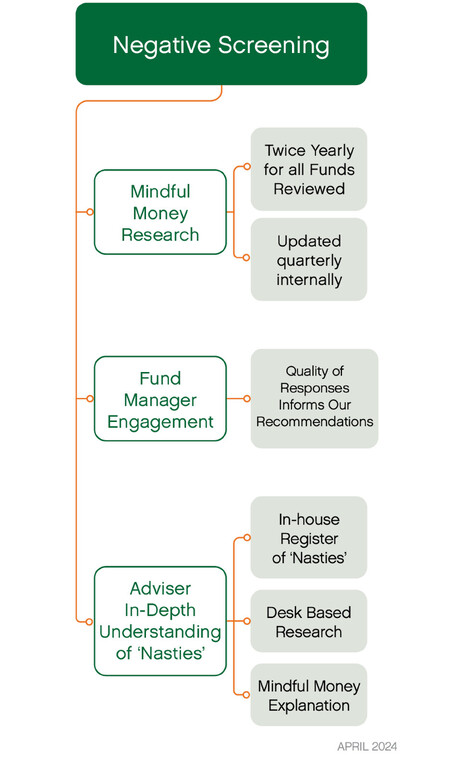

There are three branches with our Negative Screening Pillar which we have outlined these in more detail below

Three branches of our Negative Screening Pillar

Mindful Money research

Research on all our funds

We contract Mindful Money to research all the funds that we are reviewing and all the funds that we recommend to our clients.

We receive the information twice a year, when Mindful Money access the information from the Disclose Register, and we receive the information from our Non New Zealand fund managers.

This information is then put into our data analysis, where we identify changes to the 'nasties' for each fund manager and each model portfolio to assist us with further analysis.

This is now also updated every quarter for known 'nasties' through our internal Quarterly Stock Intersection Analysis, meaning that our clients have up to date information based on each quarterly reporting period.

Fund Manager Engagement

Justification as to why they hold the 'nasties'

Identifying 'nasties' through negative screening can bring up some glitches and by necessity relies on historic information. When new 'nasties' are identified through the research we contact the fund managers to find out why they hold these 'nasties'.

This requires us to have a strong knowledge of the Mindful Money methodology, framework and inputs to understand the 'nasties' categories and companies identified.

The engagement that we receive from the fund manager informs our ability to recommend them to our clients. We learn a lot from our fund managers, and it is interesting when a company comes up with multiple fund managers, to compare the different responses that we receive from the fund managers, the information from Mindful Money and our own research.

From time to time, this engagement leads to a change in the categorisation of a nasty within the Mindful Money system - we are proud to be able to add value this way.

Adviser in-depth understanding of 'nasties'

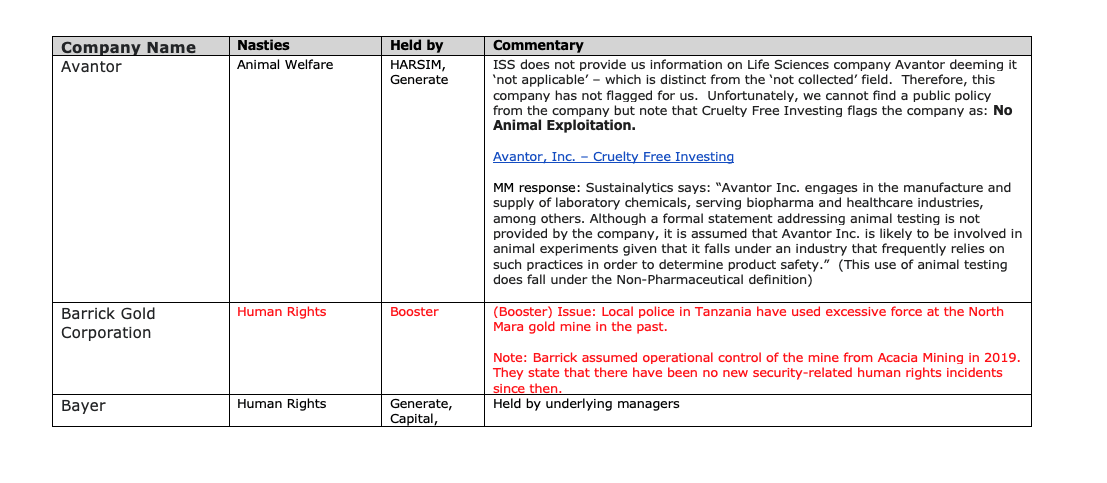

We need to be able to explain these 'nasties' to our clients, so we need to understand the companies in-depth

After the personalised ethical investment analysis for each client we have a full list of their 'nasties' and $ and % exposure - we report by category and the top 10 companies, but the information is available for us answer any clients queries. We have had questions relating to wanting no exposure to weapons, Amazon and DGL to name a few and were able to tell the clients exactly what their exposure is.

Whilst we report on the top 10 companies in the annual review and financial plan, we believe that we need to understand these in more detail ourselves.

We seek information from our fund managers on their justification for holding these 'nasties', to go with the information from Mindful Money and our own research.

We track this in a (currently 57 page) document, adding the information from different sources as a quick reference to be able to answer questions and for our own knowledge. We have added a screenshot to the left.

Moneyworks NZ Ltd

P: 0800 225 621

E: contact@moneyworks.co.nz

P O Box 1003, Cambridge 3450

Licensed Financial Advice Provider - FSP 15281

Regulatory Information: Moneyworks is a Licensed Financial Advice Provider (FSP15281), and AML Reporting Entity and is supervised by the Financial Markets Authority.