Fund Manager Engagement

We believe that providing Ethical Investment Advice requires a more in-depth knowledge and understanding of who our fund managers are and what they are doing, and how the portfolios that they choose interact with the portfolios from the other fund managers that we recommend.

It is not simply a matter of looking at historic performance, process, fees and people (which are the traditional four key features of selecting a fund manager).

We need to understand what their framework is for selecting and excluding investments, what they consider is 'ethical' and why, whether they actually walk the talk (with the investments that they make and within their own business). While we can do desk based research to find out the technical answers to these questions, there is no substitute to sitting in front of people and having a discussion about how they work, and how they feel about things.

We put quite high expectations on the fund managers that we recommend and explain that we see the relationship as a partnership, that involves transparent communication and an ability to engage in a forthright and clear manner with us. The results of these engagements inform our ability to recommend fund managers to our clients.

As well as our engagement with the fund managers around the 'nasties' in their portfolio's as a result of the Mindful Money research, we want to meet in person with each recommended fund manager regularly, with a specific list of questions. We had these meetings with most fund managers in 2022 and 2023 was the second year of these meetings. We enjoy the relationships that are built from these meetings and the partnerships that are being developed. However, we are also aware of the risk of bias that can develop from having such interactions and relationships.

The 2024 fund managers project is more desk based, focussing on their communications with advisers and clients, and reviewing the independent research reports for each recommended fund.

We have recently started this process and have received positive feedback from our fund managers about the questions we have asked and suggestions that we have made.

Code of Conduct for interaction with our Fund Managers

1. Respect.

a. Only ask for more information from Fund Managers that we actively work with.

b. Let Fund Manager know what the project is about well in advance and that we will be looking for a meeting (in person or Video Conference), or just written communication.

c. Provide context for why we are pursuing this particular project.

d. Organise meetings with plenty of time for us and the fund manager to prepare.

e. Send questions well in advance of the meetings, and ask for written answers if possible, so that we can optimise the time that we spend with the people.

f. Read the published information to find the answers where possible.

g. Read the information provided by the Fund Manager in advance of the meeting, and identify any further questions or unanswered questions.

h. Send those additional questions to the fund manager with advance notice so that they can prepare.

2. No ambushes.

a. We don’t turn up and ask fund managers questions that we haven’t provided them with in advance (where possible).

b. Some questions may come out of the discussions, and it is anticipated that these may have to be answered after the meeting.

3. No ‘tick the boxes’ projects.

a. Our projects are designed for us to get an in-depth understanding of what is happening with each fund manager, to give us confidence in what they are doing.

b. We prepare ourselves with a good level of knowledge and understanding of the operations of each fund manager before taking their time with an in person meeting.

c. Any ‘tick boxes’, should be able to be answered from publicly available information or third party research.

4. Partnership (but be aware of confirmation bias)

a. Be constructive where we think we may be able to help the Fund Manager get better.

b. This may be with ideas that we have seen in publicly provided information with other fund managers, it may be helping the Fund Manager to make their information clearer, or easier to find.

c. Provide feedback to the fund manager on the quality of information they provided (including appreciation).

We have provided more information below on the following four key aspects of our fund manager engagement branch.

Annual Fund Manager Project

In person visits with an agenda/project

Getting to know the people who are investing our clients money in person is important to us, as well as developing a strong information flow framework.

We have found that the fund managers that we recommend are readily available to meet with us as long as we are making good use of their time. We arrange our meetings in Australia and New Zealand well in advance.

We send our questions/project in advance, and request to receive responses in writing in advance so that we can analyse them and focus our in person time with the fund managers.

These are an opportunity for us to learn more about the Fund Manager's values, style, personality and learn more than the words written on the page, but also to test the validity of the words that are written and make sure that the Fund Manager is actually doing what they say they are doing.

Where possible all three advisers attend these meetings to enhance our knowledge, but also because we all have different perspectives and ask different questions.

Quarterly Stock Intersections Analysis

Core to our ongoing stock and fund manager monitoring

Using our data crunching robot, Millie, we access information quarterly on all of the funds being monitored and recommended. We have agreements with all our fund managers that this information is confidential and used in-house for our purposes.

The process has four main outputs:

What has changed in the fund managers portfolio in the last quarter - enabling us to understand what is happening and how the fund manager is adding value (or not).

After de-duplicating information (as fund managers call the same company different things, eg National Australia Bank could be NAB or Nat. Aust. Bank), Millie prepares worksheets for us to use to look at the actual holdings of the fund managers that we are analysing.

We then manually compare the holdings of different fund managers in our investment committee meeting. Our goal is to ensure that we aren't just duplicating the same fund over and over again.

This analysis ensures that our Fund Managers are adding value through diversification and that our active fund managers aren't benchmark hugging.

Millie compares the added, deleted, increased and decreased holdings to the list of nasties from the last Mindful Money analysis, and updates the master worksheet that is used in the personalised analysis for clients, while alerting us to the changes for our information.

We expect our fund managers to do this, so we feel we should do this too.

As mentioned, we see our relationship with our recommended fund managers as being a partnership (while being aware of any confirmation bias that might develop from having a strong relationship). We want to know our fund managers well, but we also want them to be the best that they can be.

As a result we have committed to actively engaging with our fund managers to help them be the best, to do the best for our clients. Active Engagement may be around a particular investment and asking what action they are taking with a controversy and their stewardship, or it may be sharing our knowledge about the financial advisory industry in New Zealand to assist them with their distribution.

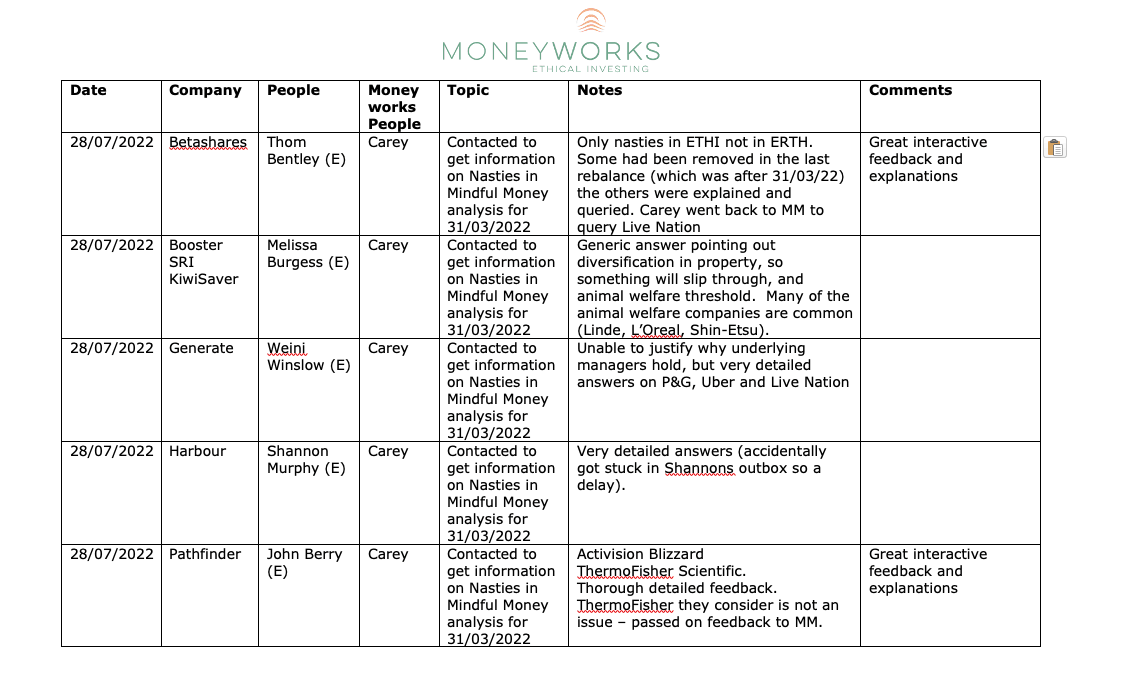

We maintain an Active Engagement Register, a screenshot is shown on the left and the 2022 Active Engagement Register is attached for you to download and peruse.

Underwriting funds availability in New Zealand

Ensuring that the funds we want to recommend are available in New Zealand - We are not remunerated for underwriting funds in any way

Moneyworks have made commitments to a wide range of fund managers that we want access to that we will support them for distribution in New Zealand, and ensuring that they are added to the FNZ and OneAnswer Platform.

These include funds like Alphinity Sustainable Share Fund, Nanuk New World Fund, Artesian Green and Sustainable Bond Fund amongst others.

We are aware that some of these funds would not be available in New Zealand without that commitment of support from Moneyworks.

We don't believe that we have any conflicts of interest as these funds are fully researched, they get the relevant place in our model portfolios (and therefore our client portfolios - and we don't receive any remuneration from this exercise. We do this to provide suitable investments for our clients.

Moneyworks NZ Ltd

P: 0800 225 621

E: contact@moneyworks.co.nz

P O Box 1003, Cambridge 3450

Licensed Financial Advice Provider - FSP 15281

Regulatory Information: Moneyworks is a Licensed Financial Advice Provider (FSP15281), and AML Reporting Entity and is supervised by the Financial Markets Authority.