Desk Based Research

This is a key to our initial analysis of fund offerings. Based on the information analysed a number of funds do not make it to the next stage of Fund Manager engagement. There are four branches to this pillar.

Four branches to this Pillar

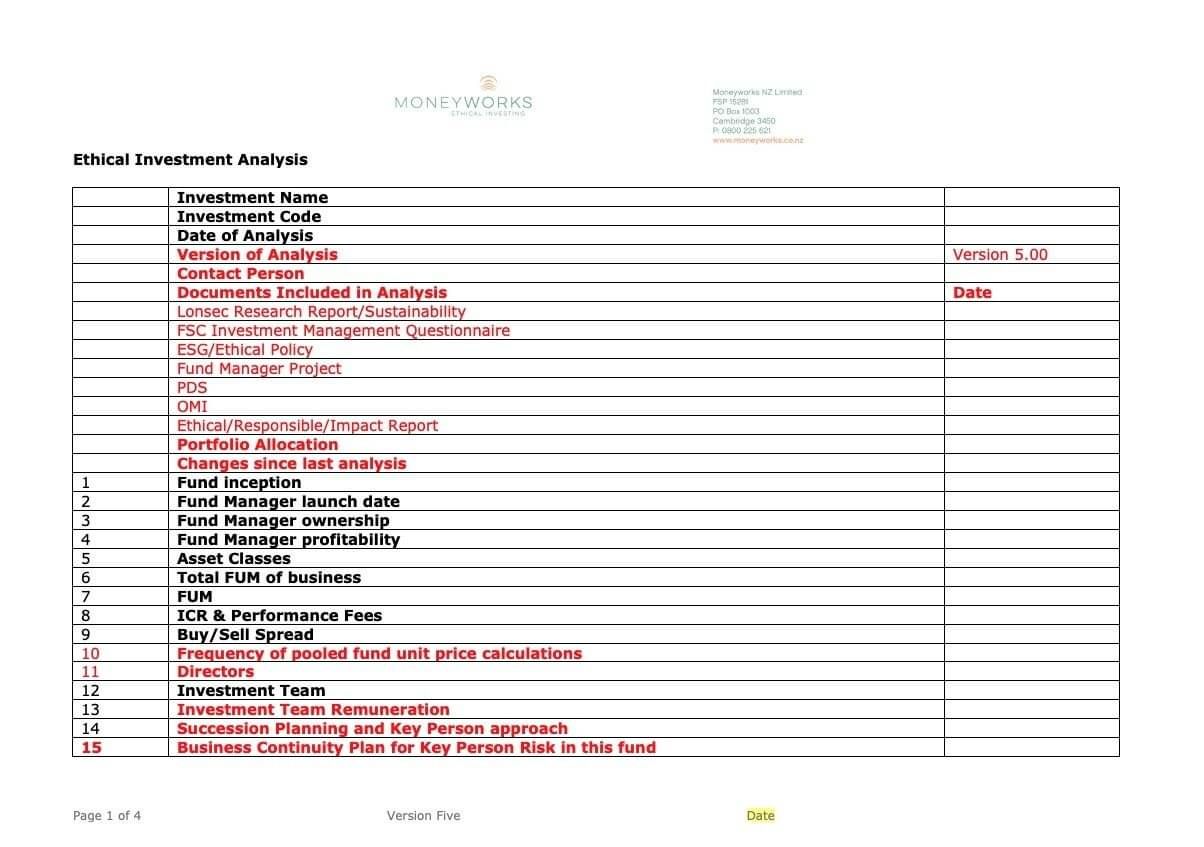

Internal 68 Question Ethical Investment Analysis

Continually Evolving

This template changes as more information becomes available, or the information is no longer adding value. The document is designed to be updated on a regular basis (usually after the fund manager project, or if there are material changes to the offering).

Third Party Research Inputs

External Research inputs

We subscribe to a number of research providers, which all have a particular 'added value'.

Mindful Money (6 monthly identification of 'nasties')

Morningstar (monthly investment performance and alerts on changes within funds and fund managers)

Lonsec (detailed in depth fund manager research reports, including commentary on Ethical investing approach)

Farrelly's (Asset Allocation guide)

RIAA Certification (verification of our research)

Fund Manager Documentation

Information available from each Fund Manager

These are the staple documents that would be expected from an ethical fund manager (but not all fund managers currently have an impact/esg annual report).

Ethical/ESG policy and process documentation

PDS and Other Material Information

SIPO

Website and other available information

Impact/ESG annual report

Quarterly Stock Intersection Process

What is this and how do we use it?

Using our data crunching robot, Millie, we access information quarterly on all of the funds being monitored and recommended. We have agreements with all our fund managers that this information is confidential and used in-house for our purposes.

The process has four main outputs:

What has changed in the fund managers portfolio in the last quarter - enabling us to understand what is happening and how the fund manager is adding value (or not).

After de-duplicating information (as fund managers call the same company different things, eg National Australia Bank could be NAB or Nat. Aust. Bank), Millie prepares worksheets for us to use to look at the actual holdings of the fund managers that we are analysing.

We then manually compare the holdings of different fund managers in our investment committee meeting. Our goal is to ensure that we aren't just duplicating the same fund over and over again.

This analysis ensures that our Fund Managers are adding value through diversification and that our active fund managers aren't benchmark hugging.

Millie compares the added, deleted, increased and decreased holdings to the list of nasties from the last Mindful Money analysis, and updates the master worksheet that is used in the personalised analysis for clients, while alerting us to the changes for our information.

Moneyworks NZ Ltd

P: 0800 225 621

E: contact@moneyworks.co.nz

P O Box 1003, Cambridge 3450

Licensed Financial Advice Provider - FSP 15281

Regulatory Information: Moneyworks is a Licensed Financial Advice Provider (FSP15281), and AML Reporting Entity and is supervised by the Financial Markets Authority.