Moneyworks proprietary and unique ethical analysis process

There are three stages to the Moneyworks Ethical Investment Analysis

1. Understanding our clients Ethical Investment Preferences

We discuss our clients preferences and opinions when we meet them and then annually at our annual review meeting. Clients rank the 'nasties' categories based on a score of 1 (Comfortable with), 2 (Prefer not to hold) and 3 (No exposure if possible).

This information then feeds into whether our clients have a fully Ethical Portfolio or a Hybrid portfolio (which has more exposure to active engagement instead of sustainable and impact investing).

2. Ethical Investment Analysis number crunching

Partnering with Mindful Money, we analyse the holdings of each fund manager that we review and recommend.

This information is then fed into a personalised ethical investment analysis for each client, based on the investments that they hold in KiwiSaver, their portfolio and some other direct funds. After crunching the numbers, we produce a report which is included in the financial plan and annual review, which shows each client in a graph what exposure they have (by different investment type) to each of the 'nasties'.

The ethical analysis then drills down into the actual dollar exposure by each investment type and nasty and identifies the top 10 underlying 'nasties' companies held by that investor, and we provide a brief summary in the report of why the investment is concerning.

Behind these reports is an extensive analysis that enables us to dig deeper for any client on a particularly 'nasty' (eg weapons) and identify which companies are actually involved in egregious behaviour (like making weapons) as compared to being suppliers to the weapons companies. This in depth information enables investors to avoid the 'nasty' company (if possible), and if not possible to understand the material allocation to that company (for example it could be $23!).

3. Ethical investment Education

Educating our clients about the investment issues has always been a core value at Moneyworks. We do this through our public seminars, in our annual review documentation (with a separate project each year) and importantly through our monthly newsletters. As well as the monthly newsletters that you can sign up for and that are on this website, our Membership Fee/Investment clients receive additional more detailed newsletters from time to time as required.

Scroll to the bottom of the page and click on the relevant box to find out more about each stage of the process

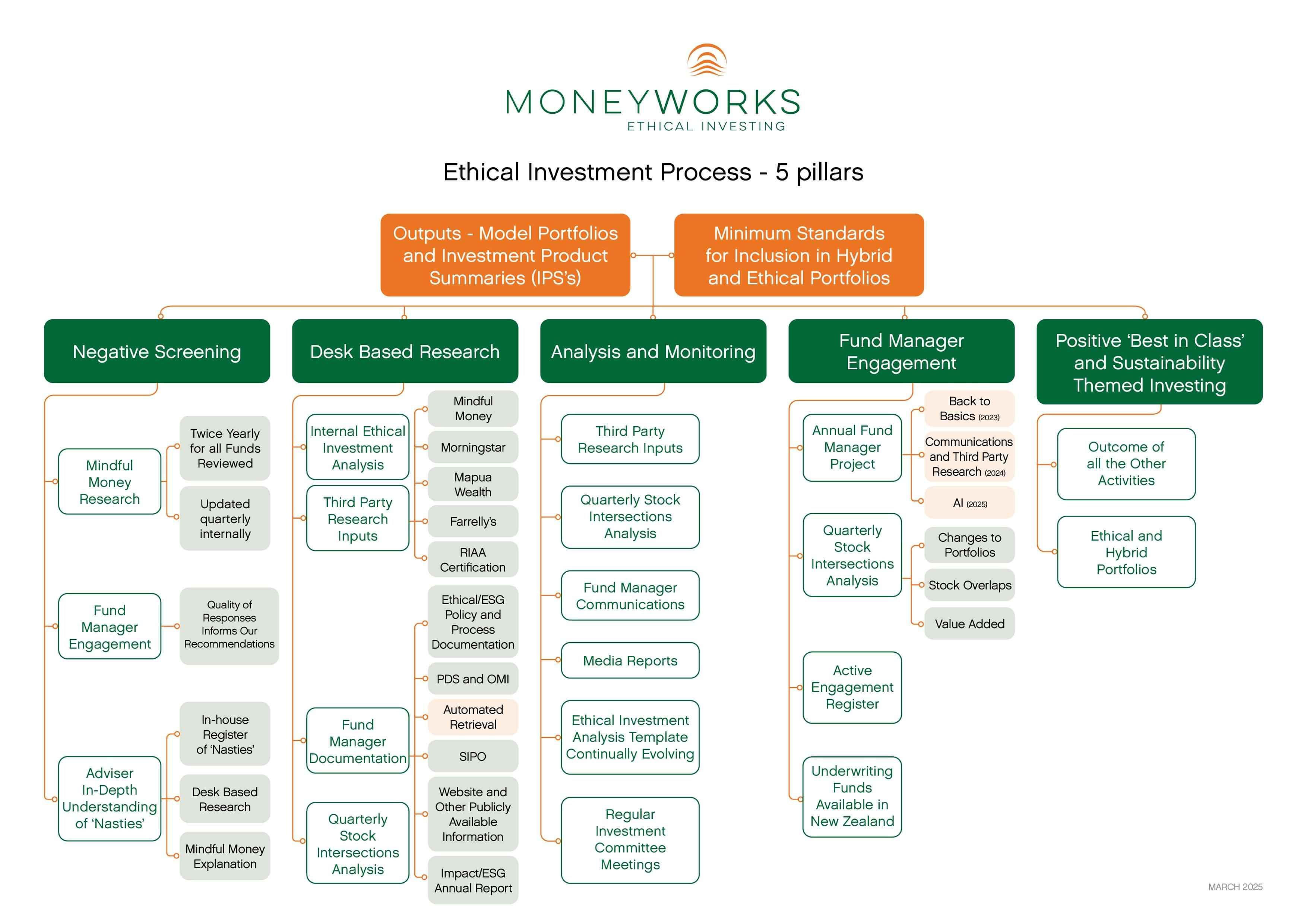

Moneyworks Ethical Investment Process

Our Ethical Investment Options Process is our only Investment Policy and Process and has been developed and improved since 2020. There are five separate pillars - and more information is available on each pillar by clicking on the relevant box below.

The OUTPUTS from this process are our Model Portfolios and our Investment Product Summaries and Ethical Investment Analysis (each is outlined in more detail below)

The full Ethical Investment Analysis Policy and Process Manual is available for you to download from the button below, but it is a long and detailed document so we have summarised the information on these web pages to make it easier for you to access.

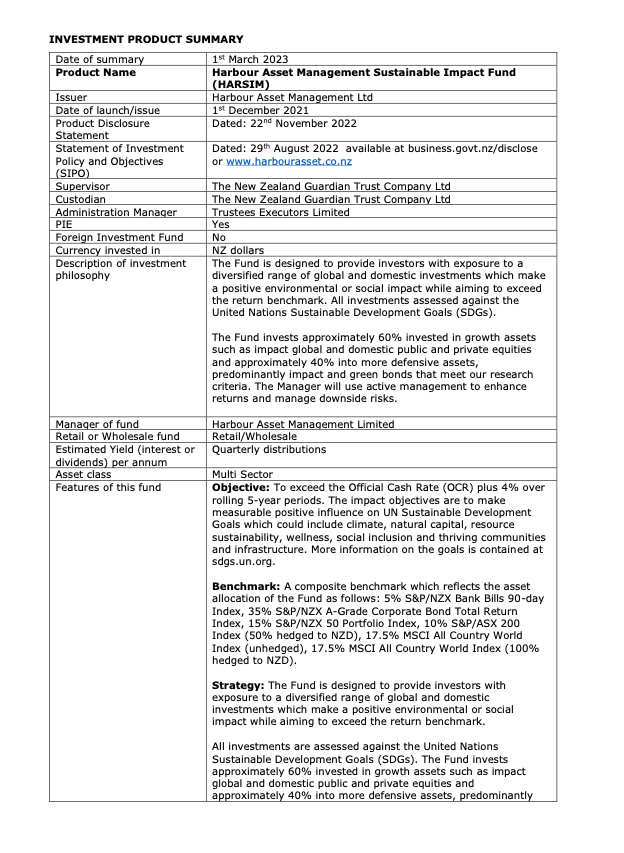

Investment Product Summary (IPS)

This is an internal document that we have prepared for our clients since 2010. This document summarises all the important things that we need our clients to know about the funds that we are recommending (particularly important following the changes to the PDS which only have proscribed information).

These were originally provided to clients at each annual review in hard copy, then on a CD Rom, then a USB Stick (still provided in new Financial Plans) and now at annual reviews by a Google Drive link.

This information includes the fees charged by the fund manager, any rebates that our clients receive, the fund sizes, the risks, and why we recommend the funds.

We aim to update these when PDS and material information is updated and are currently working on a process to automate these updates to have as up to date information as possible.

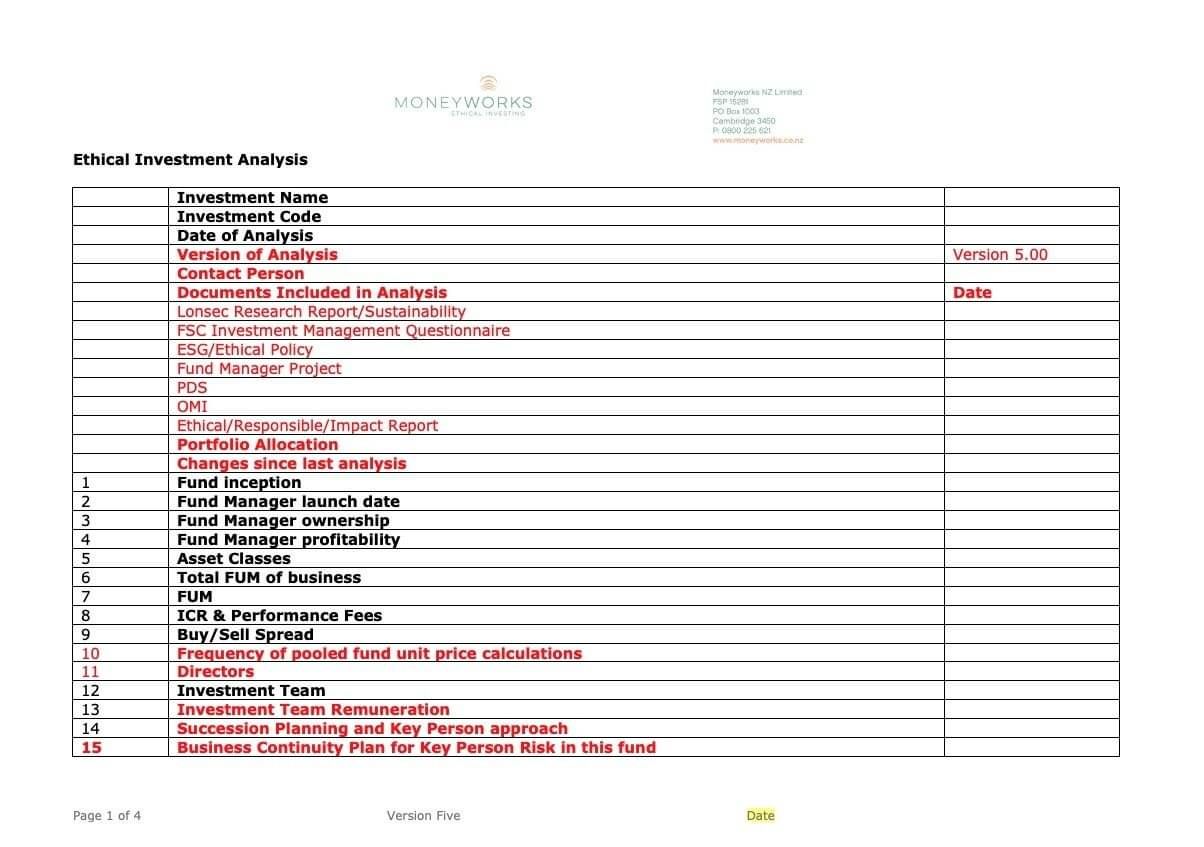

Ethical Investment Analysis - Internal

This 68 question ethical investment analysis is the core of our initial research into a fund manager and incorporates information from all sources outlined on the buttons below.

Starting with Desk Based Research incorporating Third Party Research, Fund Manager produced information, Publicly Available information on the Fund Manager and buttressed by the Negative Screening results from the Mindful Money Research, the Ethical Investment Analysis highlights the issues, features and any concerns that we may have about a fund manager.

We aim to update these analyses after the annual fund manager project is completed.